A CME gap refers to a price gap that appears on Bitcoin CME futures charts when the Chicago Mercantile Exchange closes for the weekend while Bitcoin continues trading on spot markets. When CME trading resumes, the futures price often opens significantly higher or lower than the previous close, leaving an untraded price range on the chart. This gap becomes a key technical reference point for traders.

Historically, Bitcoin has shown a strong tendency to revisit and “fill” these gaps. Market data suggests that nearly 90% of CME gaps eventually close, making them powerful magnets for price action. Traders interpret these gaps as areas of unfinished business where liquidity is likely to be revisited.

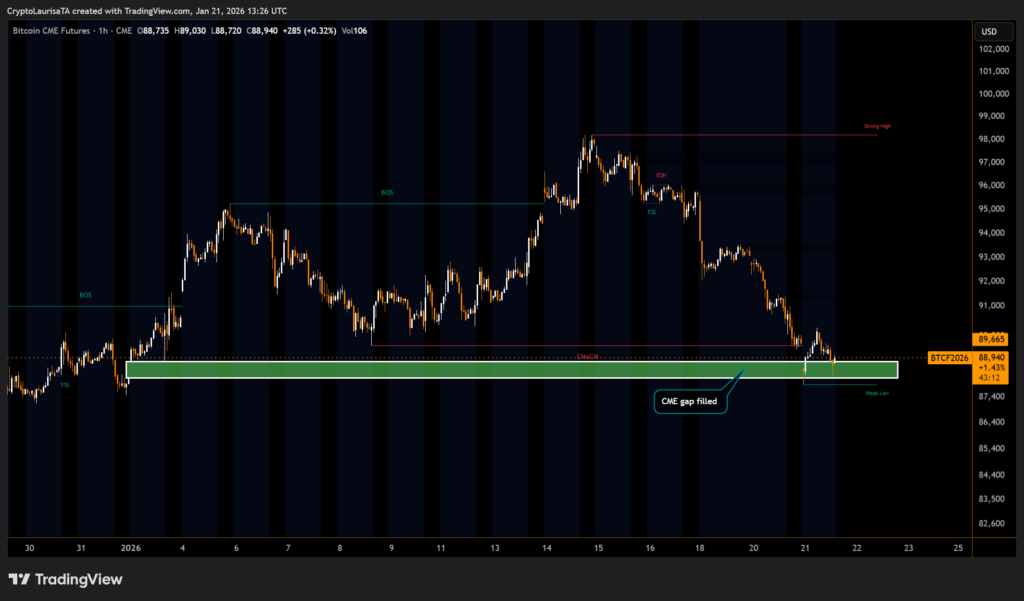

BTC CME Gap at $88K Finally Closed

The recent decline in Bitcoin pushed price action back into the $88,000 CME gap zone, which has now been fully filled. This move came after a sharp sell-off from the mid-$90,000 range, aligning precisely with historical behavior seen during periods of heightened macro and geopolitical uncertainty.

The completion of the $88K gap removes a major technical downside target that had been weighing on short-term sentiment. In past cycles, similar gap closures often marked either a temporary bottom or a consolidation phase before the next decisive move.

Why the Real Move May Still Be Ahead

While the gap fill is a significant technical milestone, it does not automatically signal a trend reversal. CME gap closures often precede increased volatility rather than immediate price stability. Traders now shift focus to liquidity levels above current prices, previous highs, and broader market conditions.

Bitcoin’s structure suggests the market is at an inflection point. With the CME gap resolved, attention turns to whether buyers can reclaim key resistance zones or if broader risk-off conditions will continue to dominate.

In short, the $88K CME gap is closed, but history indicates that the most meaningful price action often follows after the gap is filled, not before.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.