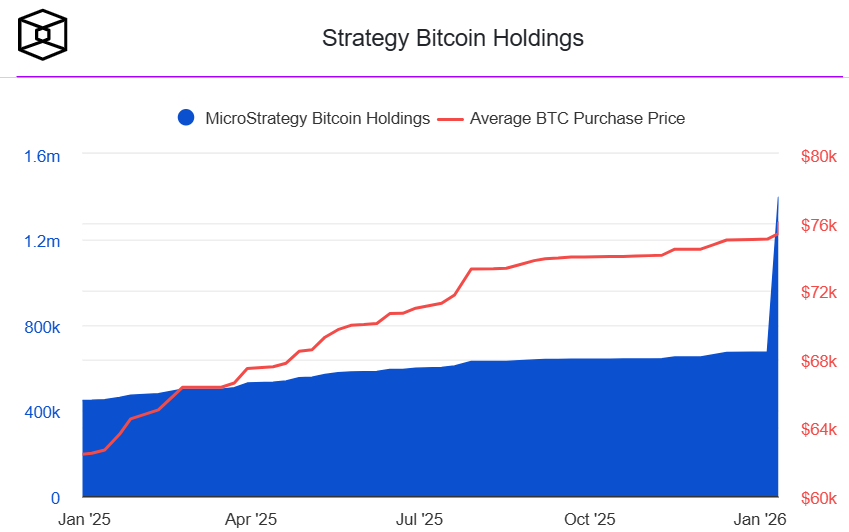

Strategy has continued its aggressive Bitcoin accumulation, acquiring 2,932 BTC for approximately $264 million in late January. The purchase was executed at an average price of $90,061 per bitcoin, pushing the company’s total holdings to 712,647 BTC. This move reinforces Strategy’s position as the largest corporate holder of Bitcoin globally, even as broader crypto markets face renewed pressure.

According to the company’s co-founder and executive chairman, Michael Saylor;

At current prices, the firm’s Bitcoin treasury is valued at around $62.5 billion, compared with a total acquisition cost of roughly $54.2 billion. This translates into paper gains of more than $8 billion, while representing about 3.4% of Bitcoin’s fixed 21 million supply.

Funding Through Equity and Preferred Stock

The latest acquisition was financed through at-the-market sales of Class A common stock and perpetual preferred shares. Strategy sold a portion of its common equity and preferred instruments, while maintaining billions of dollars in remaining issuance capacity under existing programs. These funding channels operate alongside the company’s long-term capital plan, which targets up to $84 billion in financing through 2027 to support further Bitcoin purchases.

Stock Performance

Despite its expanding Bitcoin position, Strategy’s share price remains under pressure, trading well below prior highs. Management has stated that the company’s diversified capital structure is designed to withstand extended downturns in Bitcoin prices, even though equity holders could still face significant volatility.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.