Global asset manager VanEck has expanded its digital asset lineup with the launch of the first US-listed spot Avalanche exchange-traded product, offering investors direct exposure to Avalanche’s native token, AVAX. The fund trades under the ticker VAVX and tracks the spot price of AVAX, while also enabling potential returns through staking rewards.

The product is not registered under the Investment Company Act of 1940, though it remains subject to other applicable US securities regulations. VanEck confirmed it will waive sponsor fees on the first $500 million in assets until Feb. 28, after which a 0.20% sponsor fee will apply across all assets.

Why Avalanche Matters in the ETF Market

Avalanche is an open-source smart contract blockchain designed for decentralized applications, known for its high throughput and low transaction costs. Launched in 2020, the network has positioned itself as a competitor to other major layer-1 blockchains.

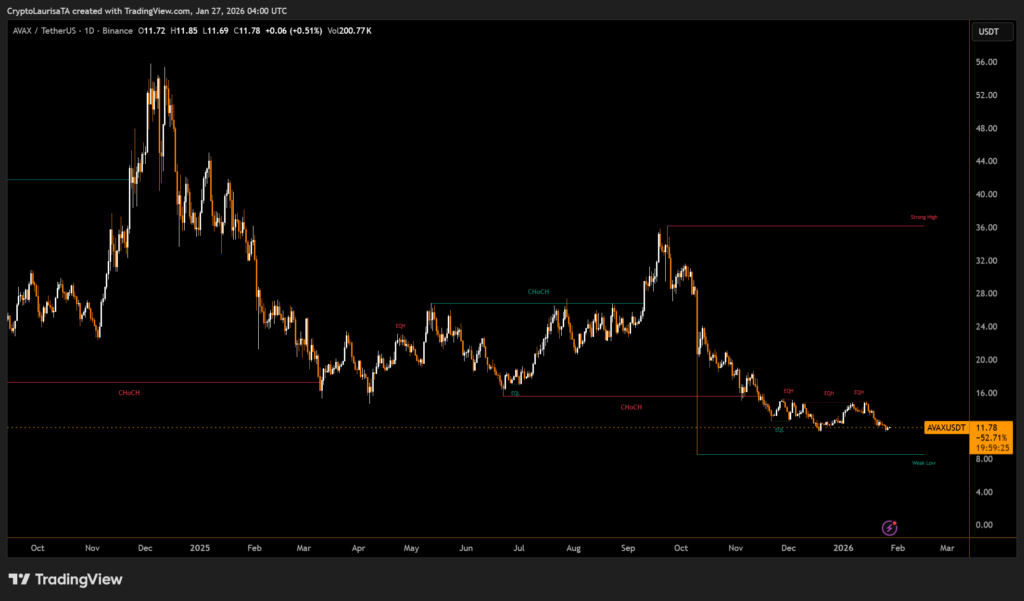

At the time of launch, AVAX carried a market capitalization of approximately $5.1 billion, trading near $11.7, well below its November 2021 peak of $144.96. Despite the price decline, institutional interest remains active.

Regulatory Momentum for Altcoin ETFs

VanEck first filed for an Avalanche ETF in March 2025, followed by a proposed exchange listing later that year. Other asset managers are also seeking approval for spot Avalanche ETFs, signaling growing confidence in regulated altcoin investment products.

Bloomberg senior ETF analyst Eric Balchunas, said on Monday ;

The launch reflects a wider trend toward exchange-traded products that go beyond simple price tracking, combining staking, income strategies, and portfolio diversification as digital assets continue moving into mainstream financial markets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.