Social media interest in silver and gold has recently outpaced cryptocurrency discussions, as retail traders react to sharp price movements in precious metals, according to market analytics firm Santiment.

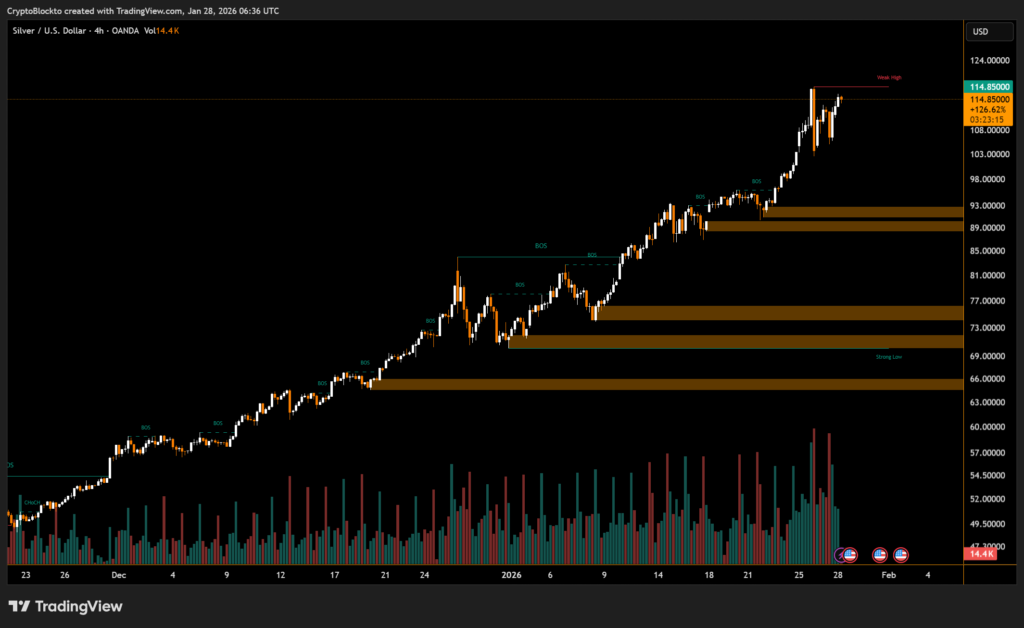

Silver surged to a new all-time high of just over $117 on Tuesday, while gold similarly attracted attention after hitting record levels in mid-January. Santiment data shows that from Jan. 1–6 and again during the first half of January, silver and gold were the most discussed assets on social media platforms.

The spike in retail attention often coincides with sharp price rallies, suggesting heightened fear of missing out (FOMO) among investors. For example, silver briefly rose above $117.70 before dropping to $102.70 within two hours, highlighting extreme volatility driven by hype.

Crypto Still Maintains Interest, But Trails Precious Metals

While cryptocurrencies saw a brief resurgence in social mentions between Jan. 19–22, precious metals quickly regained dominance. Google Trends data also reflects this pattern: silver’s search interest peaked on Jan. 22, while Bitcoin searches were highest on Jan. 21, showing crypto remains relevant but less dominant in retail sentiment during the metals’ rally.

Analysts warn that surging attention on silver and gold may indicate a near-term top, as retail traders shift focus to assets generating hype. The trend highlights the fluid nature of investor sentiment, with social media shaping market attention across both digital and traditional assets.

Silver is currently trading around $113, demonstrating ongoing volatility amid intense retail engagement.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.