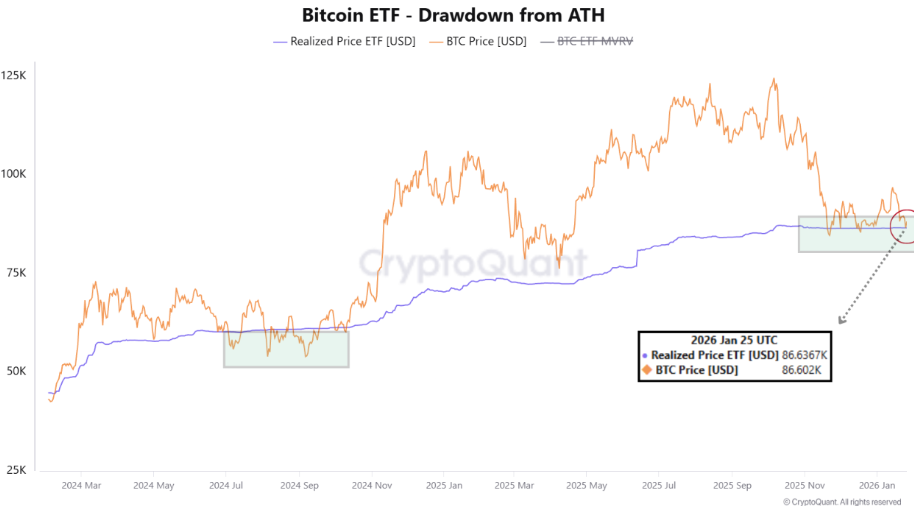

Institutional Bitcoin investors are facing a critical moment as Bitcoin ETF holdings decline sharply and prices hover near the $86,600 aggregate entry level. This level represents the average realized price at which ETF investors entered the market, turning it into a key psychological threshold.

Since reaching peak net holdings of $72.6 billion in October 2025, US spot Bitcoin ETFs have recorded over $6 billion in net outflows, reducing total holdings by more than 8%. The pullback followed Bitcoin’s retreat from its $126,200 all-time high, placing growing pressure on institutional capital.

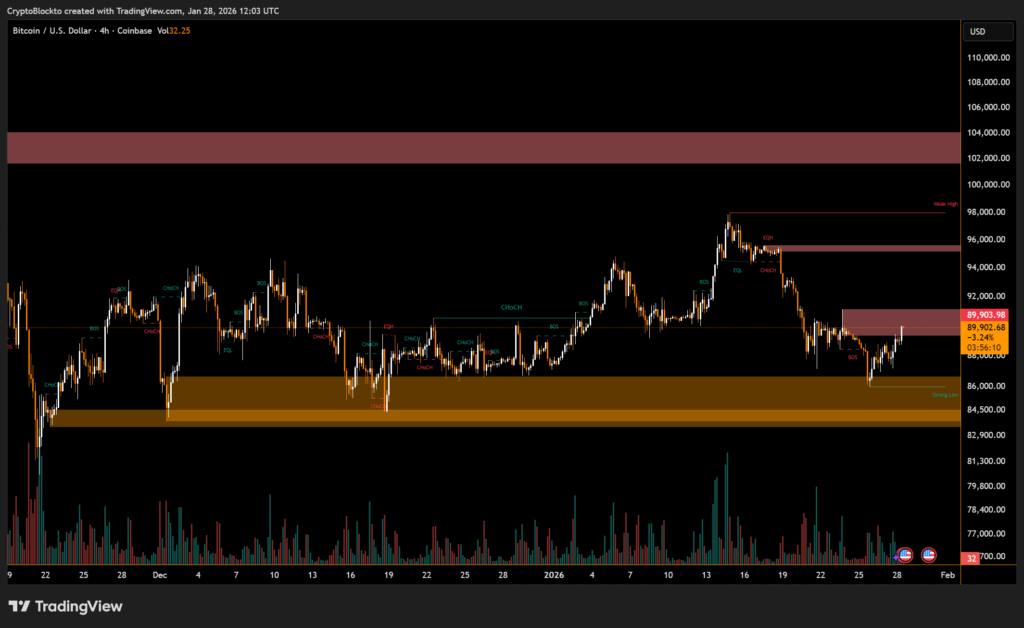

$86K Level Becomes a Psychological Pivot

With Bitcoin trading close to the realized ETF price, investors are no longer securing profits but instead deciding whether to hold through drawdowns or exit at break-even. Historically, trading above realized price tends to stabilize investor behavior, while sustained moves below it often accelerate redemptions as confidence weakens.

Despite the outflows, the ETF realized price has remained relatively stable over the past six months, suggesting that less-committed capital has already exited, while longer-term holders absorb volatility.

Institutional Demand Signals Potential Rebound

Recent weeks have seen continued ETF outflows, with limited inflows since mid-January. However, industry executives point to growing interest from major US wirehouses, which collectively oversee tens of thousands of financial advisors. Reports indicate that new approvals for Bitcoin ETF access are emerging, raising expectations that institutional participation could rebound, even as near-term price pressure persists.

As Bitcoin consolidates near this critical level, the coming weeks may determine whether ETF investors reinforce conviction—or capitulate.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.