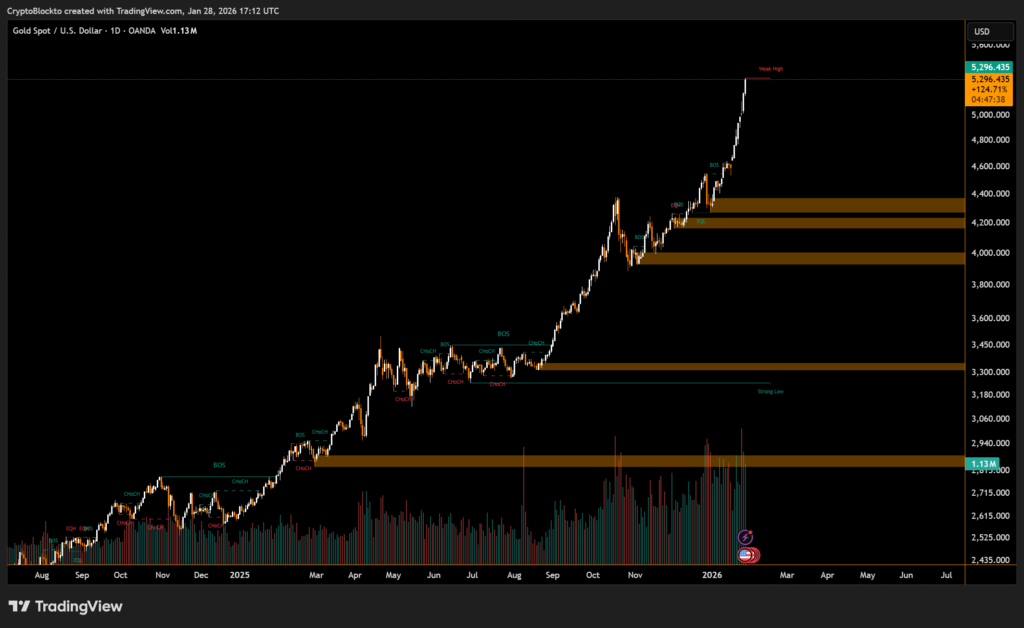

Bitcoin struggled to sustain upward momentum as gold surged to a new record above $5,300 per ounce, highlighting a divergence between crypto and traditional safe-haven assets ahead of the Federal Reserve’s interest-rate decision.

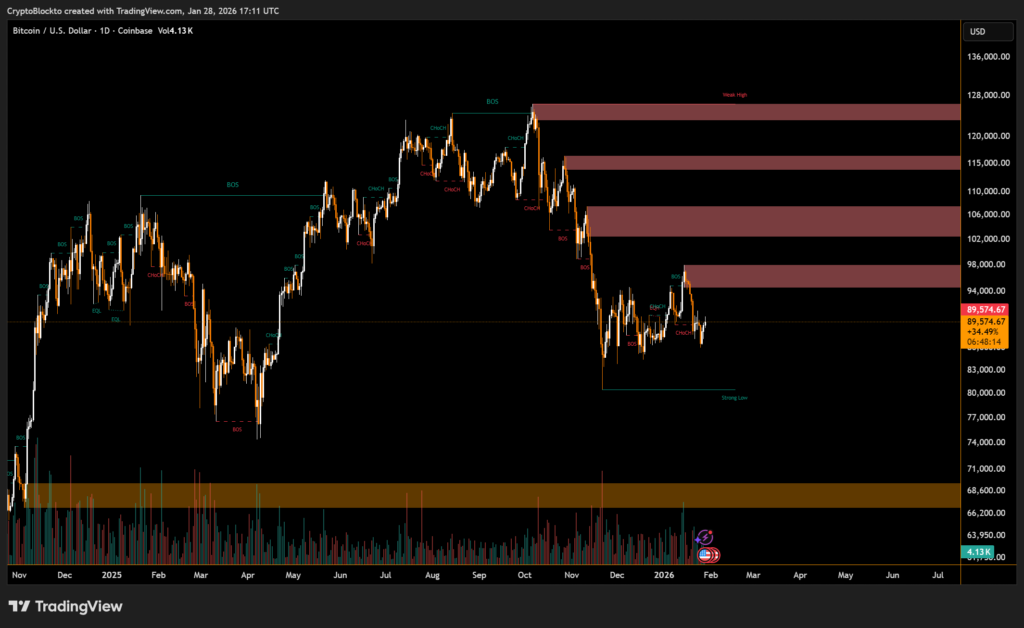

During the US market open, Bitcoin briefly approached $90,500 before retreating toward $88,800, reinforcing $90,000 as a key resistance level. Equity markets remained largely flat as investors waited for signals from the Federal Open Market Committee, with expectations centered on unchanged rates and closer attention on forward guidance.

Weak Dollar and Geopolitical Tensions Boost Gold

Gold’s rally coincided with a sharp decline in US dollar strength, as policymakers appeared tolerant of a weaker currency to support exports and asset prices. The US Dollar Index recorded its weakest annual performance in eight years, adding fuel to the metal’s upside.

Geopolitical concerns also supported demand for safe assets, with rising tensions in the Middle East contributing to risk-off flows into gold.

Bitcoin Range Tightens as Traders Await Breakout

Despite heightened macro volatility, Bitcoin remained range-bound. Traders noted that liquidity continues to cluster at the upper and lower extremes of its long-standing consolidation zone between $86,000 and $93,000.

Bitcoin cannot remain in the middle of this range indefinitely, with diminishing volatility suggesting that a decisive move either higher or lower is becoming increasingly likely. For now, Bitcoin continues to lag gold, leaving traders waiting for a clear catalyst to break the stalemate.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.