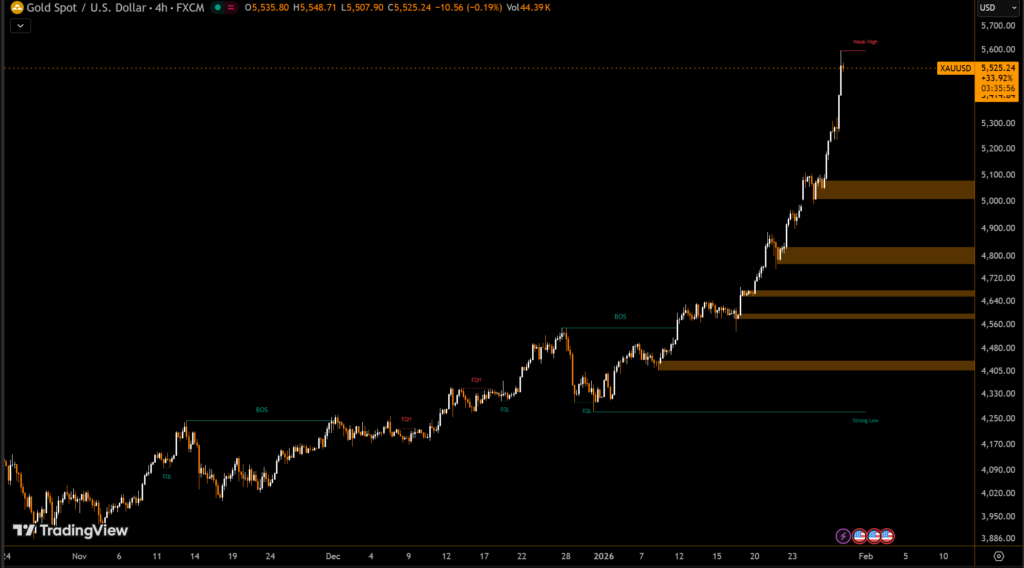

Gold prices surged sharply on Wednesday, climbing more than 6% to above $5,400 per ounce, marking a new all-time high. The rally accelerated during remarks from the U.S. Federal Reserve Chair following the decision to keep interest rates unchanged at 3.50%–3.75%. While the central bank downplayed the move in precious metals as a broader economic signal, investors clearly interpreted the message differently.

The surge highlights growing demand for traditional safe-haven assets, particularly as geopolitical tensions and fiscal uncertainty remain elevated. Silver and platinum also posted strong gains, but gold’s sheer market size — estimated near _ $40 trillion_ — made its move especially notable.

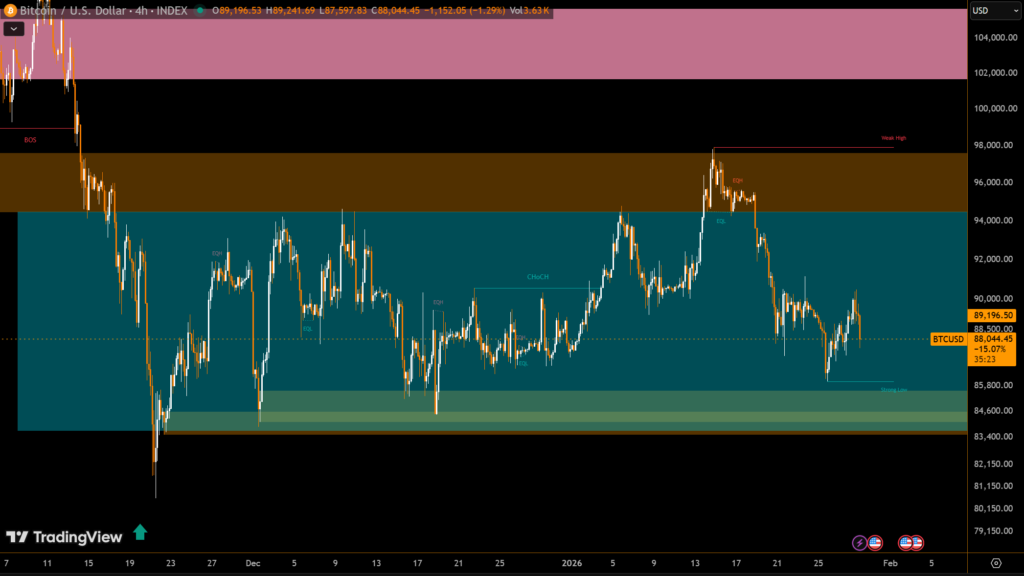

Bitcoin Struggles to Keep Pace With Gold Rally

In contrast, Bitcoin traded in a narrow band around $87,000, showing little reaction to the same macro environment that boosted gold. Over the past 24 hours, BTC remained largely flat, continuing a period of tight consolidation.

This divergence has renewed debate over bitcoin’s role as “digital gold.” Despite conditions that historically favored crypto including a softer U.S. dollar and heightened global risk bitcoin has underperformed, while gold is up over 90% year-on-year.

Digital Gold Narrative Under Pressure

The widening performance gap suggests a shift in investor preference. As capital flows back into physical gold, some market participants question whether bitcoin is temporarily losing ground as a macro hedge. For now, traditional assets appear to be reclaiming dominance in times of uncertainty.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.