Bitcoin has remained locked near the $90,000 price level, not due to fading interest, but because of how traders are positioning risk in the derivatives market. Data shows that options activity — rather than leveraged futures — is now the primary force shaping short-term price behavior.

High Bitcoin Options Volume Signals Cautious Market

Bitcoin options trading volumes remain elevated, confirming that capital and participation are still strong. However, exposure is increasingly structured through options strategies instead of outright directional bets.

This shift suggests that traders are prioritizing hedging and capital preservation, which naturally limits aggressive price expansion.

Market exposure is concentrated around key strike prices, keeping Bitcoin rangebound.

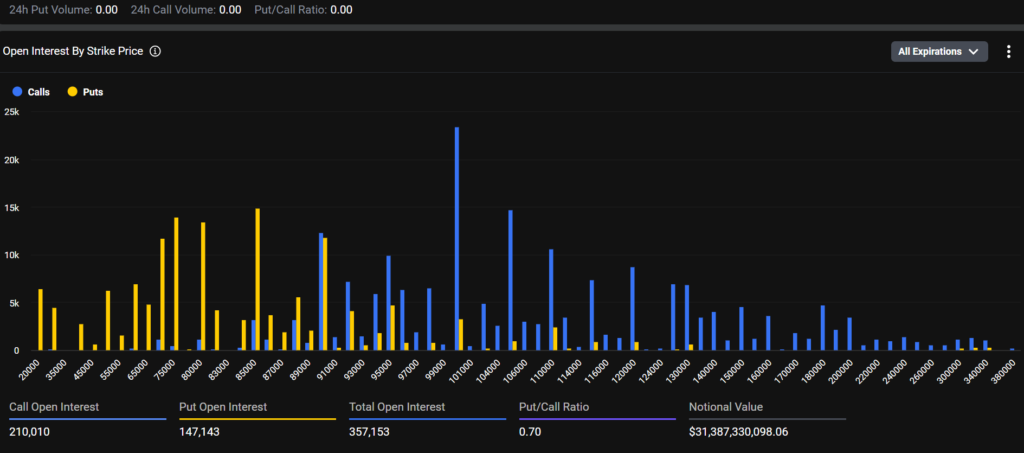

Concentrated Open Interest Creates Price Gravity

A large portion of open interest is clustered around current price levels ahead of a major near-term options expiry. This concentration creates a “pinning” effect, where price tends to gravitate toward levels with the most outstanding contracts.

Bitcoin has traded within a defined range since mid-November, with support near $85,000 and resistance near $95,000, repeatedly failing to break either side decisively.

Price movements are increasingly driven by hedging flows rather than headlines.

High demand for short-dated options, particularly protective puts, indicates that traders are actively managing downside risk. As a result, rallies often meet selling pressure from hedges, while dips attract buyers adjusting exposure.

An upcoming month-end expiry involving billions in notional value could temporarily increase volatility. With the max pain level sitting near $90,000 and open interest concentrated above current prices, positioning mechanics are likely to remain a dominant influence.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.