Bitcoin treasury firm Strive has strengthened its financial position by retiring the majority of the debt inherited from its recent acquisition of Semler Scientific, while adding 334 Bitcoin to its corporate holdings. The move follows the successful closing of a Variable Rate Series A Perpetual Preferred Stock offering, traded under the ticker SATA.

Strive reported 600 million dollars in investor demand, prompting the company to increase the size of the offering from 150 million dollars to 225 million dollars. The structure of the raise allows Strive to fund Bitcoin accumulation without increasing leverage, aligning with its long-term treasury strategy.

Debt Reduced, Bitcoin Fully Unencumbered

Using the proceeds, Strive confirmed it has retired 110 million dollars, or 92 percent, of inherited debt. This includes the conversion of 90 million dollars in convertible notes into preferred equity and the full repayment of a 20 million dollar credit facility. With that loan cleared, all Bitcoin held by the company is now unencumbered, and management plans to eliminate the remaining 10 million dollars in debt within four months.

Top 10 Corporate Bitcoin Holder

The latest purchase brings Strive’s total holdings to 13,132 BTC, valued at approximately 1.17 billion dollars, placing it among the top ten corporate Bitcoin treasury holders globally. The company also reported a 21.2 percent Bitcoin yield quarter-to-date, measuring growth in Bitcoin exposure per common share.

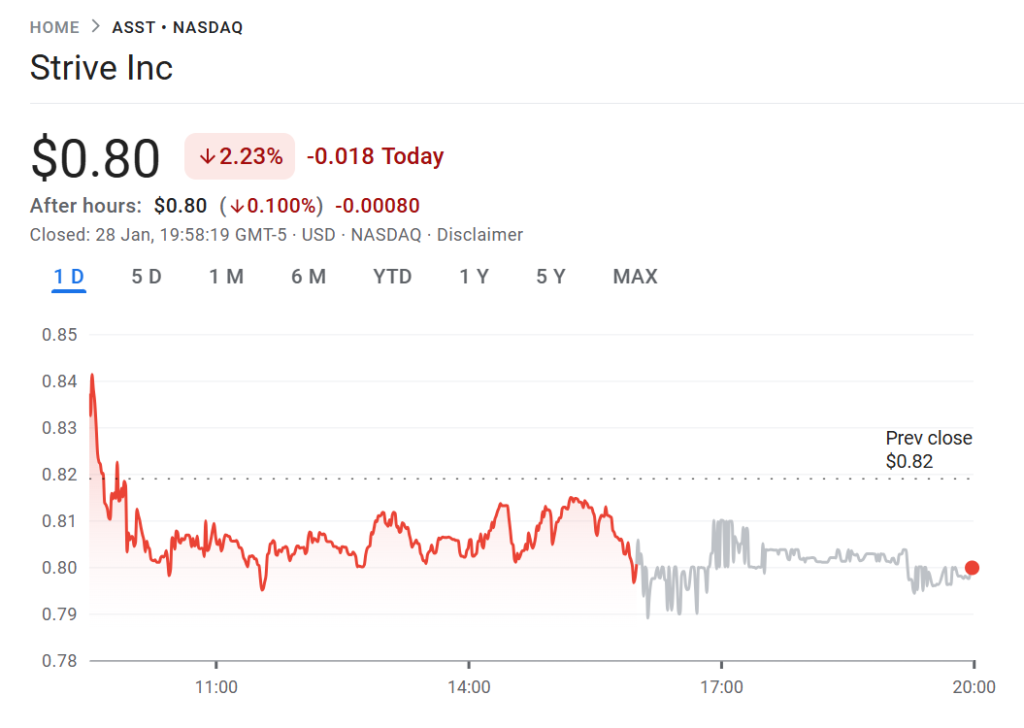

Despite the balance sheet progress, Strive’s shares declined modestly, underscoring the volatility and execution risks associated with corporate Bitcoin strategies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.