Ripple has taken a major step toward embedding blockchain technology into everyday corporate finance with the launch of a new enterprise treasury platform designed for large organizations managing complex cash flows. The solution blends traditional treasury management with blockchain-based settlement, aiming to modernize how companies handle liquidity, payments, and cross-border transactions.

Blockchain Meets Corporate Treasury Management

Built on Ripple’s acquisition of GTreasury, the platform allows treasurers to manage cash positions, payments, and liquidity within a single system while preserving existing approval structures and risk controls. By integrating stablecoin settlement rails, the platform reduces reliance on slow, multi-day banking processes and improves visibility across global accounts.

One of the platform’s key advantages is its ability to shorten settlement cycles from days to minutes. This enables companies to put idle cash to work outside traditional banking hours, including nights and weekends, without compromising internal investment policies. As a result, treasurers gain new opportunities to generate yield while maintaining operational discipline.

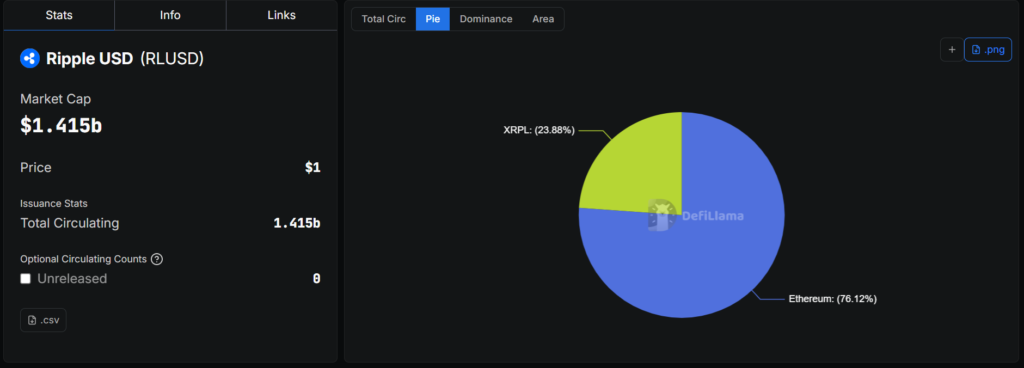

The platform also supports cross-border payments using stablecoins, helping reduce foreign exchange exposure and payment friction. Ripple’s own U.S. dollar–denominated stablecoin plays a central role, offering faster settlement and predictable value compared to volatile digital assets.

SEC Chair Paul Atkins recently said on X that;

This launch aligns with a wider industry move toward tokenization and 24/7 financial markets, as regulators and major market infrastructure providers explore on-chain settlement for traditional assets. Together, these developments signal a gradual but meaningful shift toward blockchain-powered back-office operations in global finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.