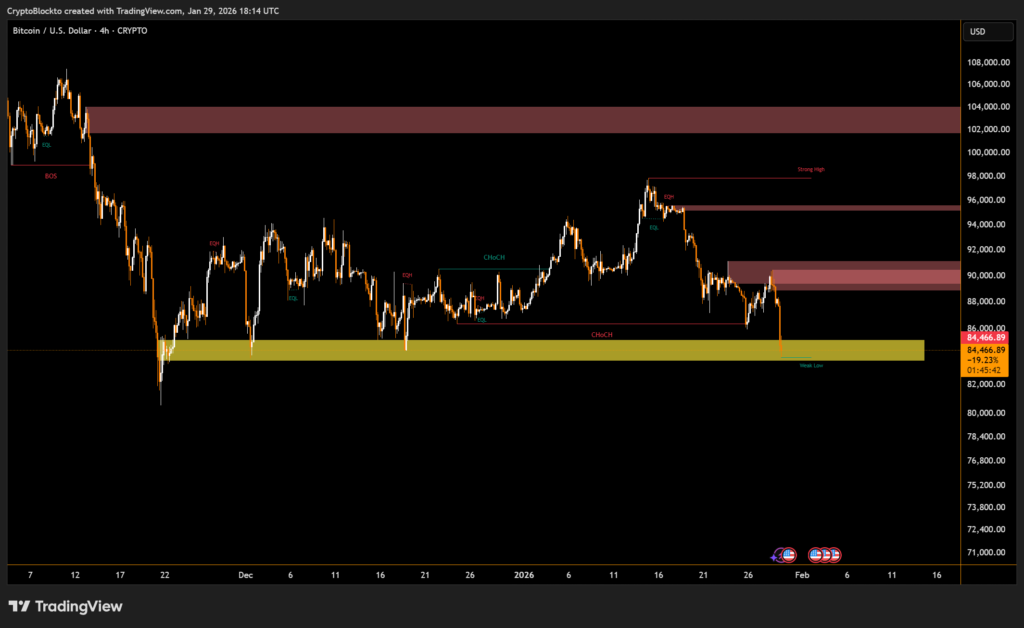

Bitcoin dropped sharply to its lowest level in two months, sliding to around $83,000 after a sudden wave of selling swept through global markets. The move marked a nearly 6% daily decline, catching traders off guard as cryptocurrencies moved in tandem with stocks and precious metals.

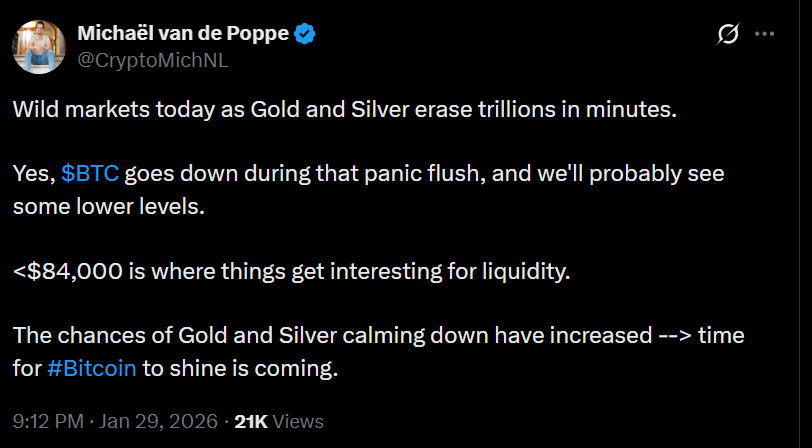

The sell-off followed an abrupt reversal in gold and silver, which had recently surged to record highs before experiencing a rapid retracement. Gold fell hundreds of dollars within minutes, creating a broader risk-off environment that spilled into digital assets.

Liquidations and Technical Breakdown Add Pressure

Bitcoin’s decline was intensified by heavy leveraged liquidations, with crypto markets seeing more than $500 million wiped out in just a few hours. Key technical levels, including the yearly open and nearby moving averages, failed to hold, accelerating downside momentum.

The sudden loss of support raised concerns among traders about whether Bitcoin can avoid further downside before the monthly close, a level many view as critical for maintaining bullish market structure.

Analyst Michaël van de Poppe wrote in a post on X;

While some market participants see the move as a necessary reset, others warn that ongoing macro uncertainty—ranging from currency confidence concerns to financial stability risks—could keep volatility elevated. Attention is now focused on whether Bitcoin can reclaim levels above $85,000 or risks entering a deeper corrective phase if weakness persists.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.