Bybit recorded a notable recovery in 2025, climbing to become the second-largest crypto exchange by trading volume despite suffering the largest hack in industry history earlier in the year. The exchange processed approximately $1.5 trillion in total trading volume during 2025, capturing 8.1% of the global crypto exchange market.

The recovery followed a February 2025 security breach in which attackers exploited a vulnerability in Bybit’s cold wallet system, stealing about $1.5 billion worth of ether. The incident marked a major stress test for the platform’s operational resilience and user trust.

Crisis Response Helped Stabilize User Confidence

Following the breach, Bybit kept withdrawals open and honored all user balances, a decision that helped prevent a broader loss of confidence. The exchange’s leadership also addressed users directly, confirming that sufficient reserves were available and that external liquidity support would be used if needed. Industry data shows that most hacked crypto platforms fail to regain their previous standing, making Bybit’s rebound unusual.

Trading Volumes Grew Across Major Exchanges

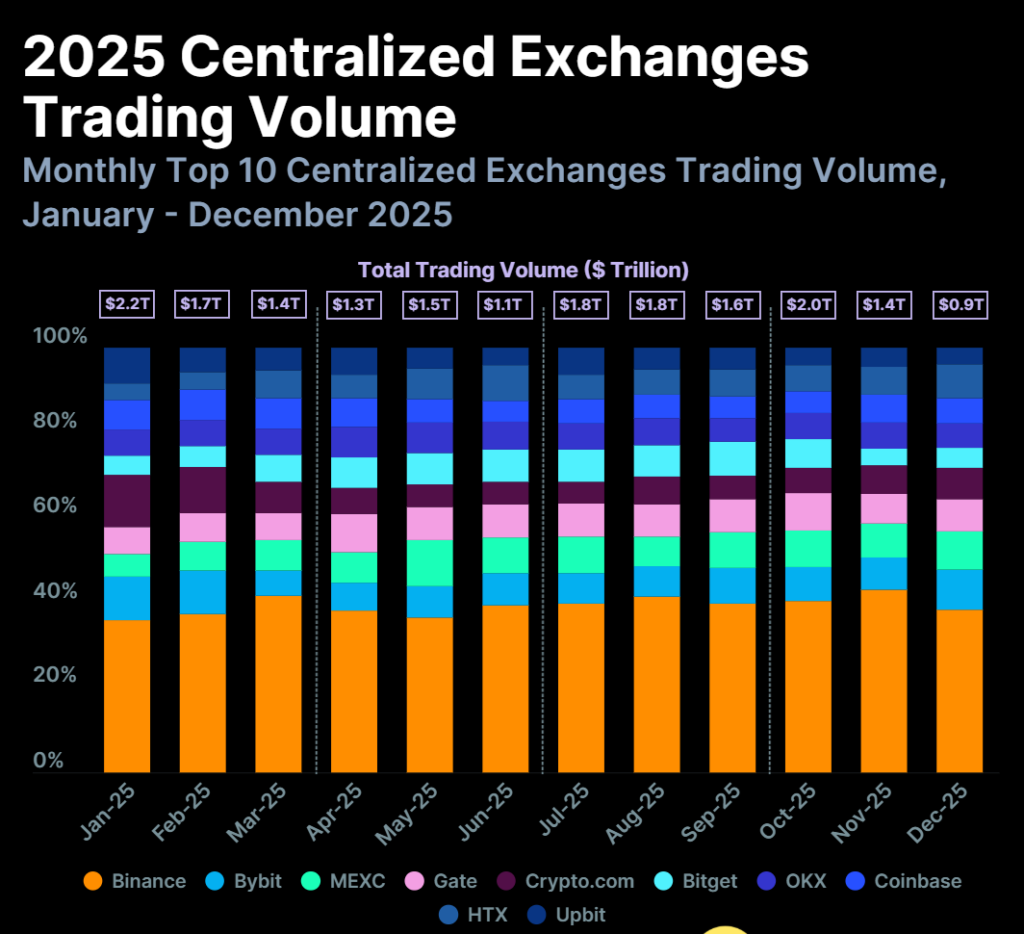

Overall trading activity increased across leading crypto exchanges in 2025. Six of the top ten platforms recorded higher volumes, with average growth of 7.6%, adding roughly $1.3 trillion in additional trades compared to the prior year. MEXC emerged as the fastest-growing exchange, with trading volumes rising 91% to $1.5 trillion, driven largely by its zero-fee spot trading strategy.

Binance retained its position as the largest crypto exchange, handling an estimated $7.3 trillion in trading volume during 2025. However, its annual volume declined slightly year over year, reflecting weaker market sentiment following major liquidation events late in the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.