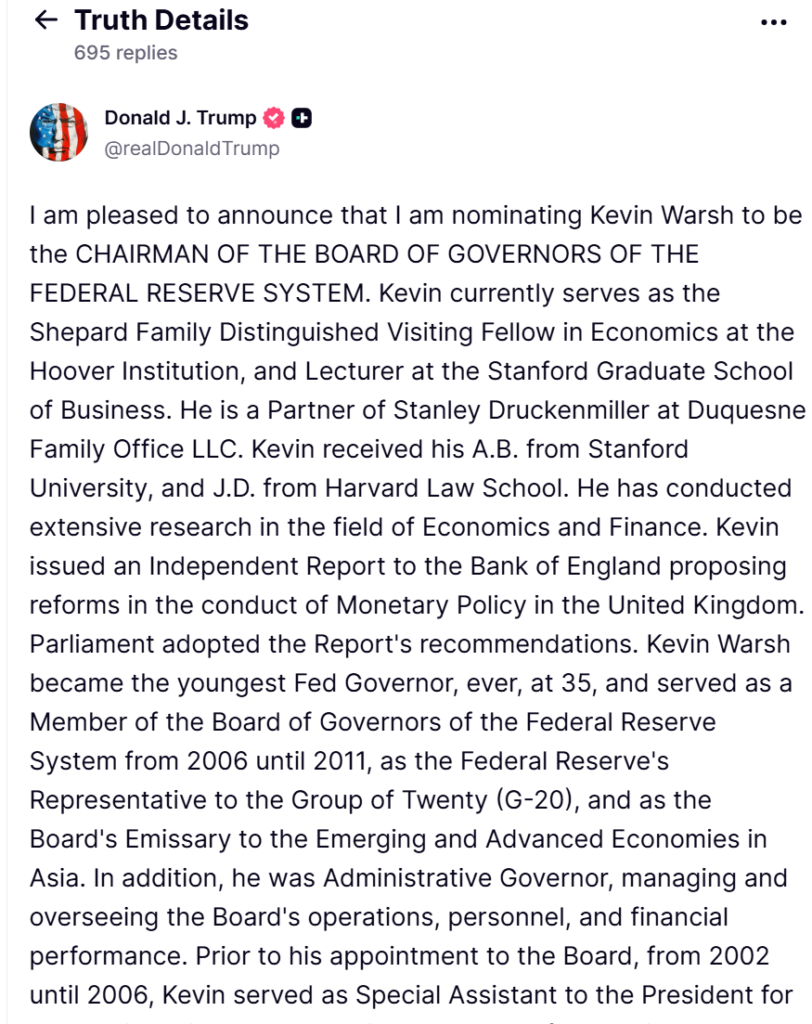

US President Donald Trump announced plans to nominate former Federal Reserve Governor Kevin Warsh as the next chair of the US central bank, replacing Jerome Powell. The move sets up a closely watched Senate confirmation process and signals a potential shift in the Federal Reserve’s approach to monetary policy and financial markets.

Warsh, 55, previously served on the Federal Reserve Board from 2006 to 2011 and later worked as a senior executive at a major investment bank. Trump described Warsh as a long-time associate and expressed confidence that he would rank among the most effective leaders in the central bank’s history.

During his tenure at the Fed, Warsh played a role in navigating the aftermath of the global financial crisis. In the years since, he has emerged as a vocal critic of prolonged loose monetary policy, repeatedly calling for a fundamental reset in how the Fed manages interest rates and its balance sheet.

Warsh’s Stance on Bitcoin and Digital Assets

Unlike Powell, Warsh has taken a more open view toward Bitcoin, arguing that digital assets do not undermine the Federal Reserve’s ability to guide the economy. In past public discussions, he suggested that Bitcoin could serve as a form of market discipline rather than a threat to financial stability.

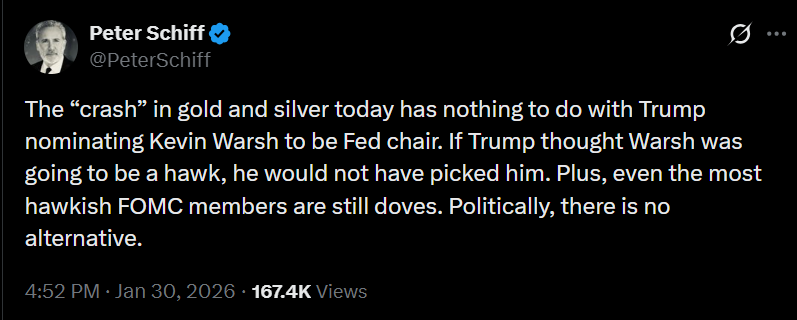

Gold advocate and analyst Peter Schiff said that ;

Financial markets have been adjusting to the prospect of a potentially more hawkish Fed leadership, with investors reassessing risk assets amid broader fiscal uncertainty. Warsh’s nomination now heads to the US Senate, where lawmakers are expected to closely examine his past policy positions and views on regulation before confirming him as the next Federal Reserve chair.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.