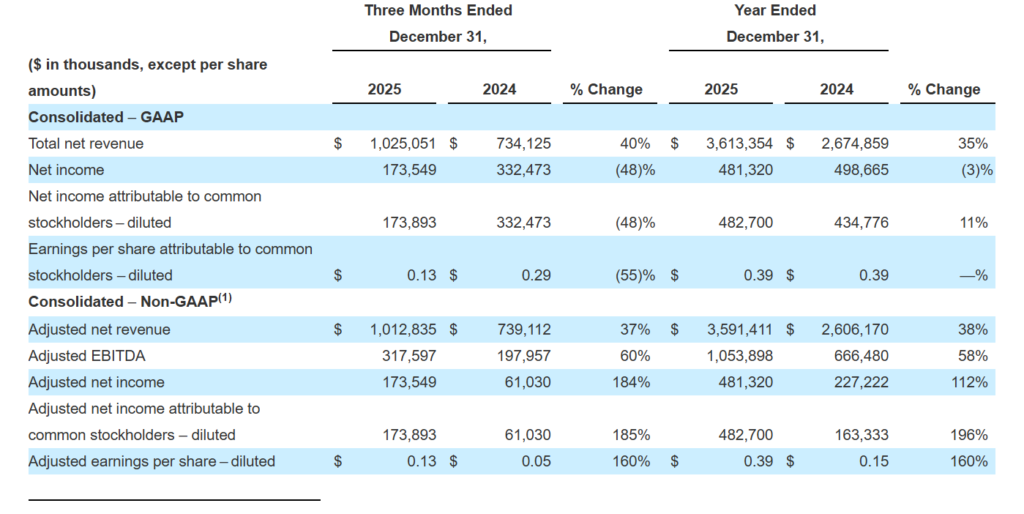

SoFi Technologies delivered record financial results in the fourth quarter, reporting adjusted net revenue of $1 billion, a 37% increase compared to the same period last year. GAAP net income reached $173.5 million, while adjusted EBITDA climbed 60% year over year to $317.6 million, highlighting improved profitability and operating leverage.

Fee-based revenue also hit a quarterly record of $443 million. The company’s member base expanded by approximately 35% to 13.7 million, supported by the addition of 1.6 million new products during the quarter. Total financial services products rose 38% year over year to 17.5 million.

Crypto Relaunch and Blockchain Expansion

The results follow SoFi’s reentry into the cryptocurrency market after a pause in late 2023. In June, the fintech bank reinstated crypto trading, enabling customers to buy, sell and hold digital assets. Toward the end of December, SoFi recorded 63,441 crypto products, reflecting activity from its relaunch period rather than a full quarter.

SoFi also expanded blockchain-based remittance services to more than 30 countries and introduced SoFiUSD, a US dollar–backed stablecoin issued through its regulated banking subsidiary.

SoFi’s renewed crypto focus aligns with a broader trend among major banks exploring digital asset services, including stablecoins and crypto trading. The growing institutional interest signals increasing acceptance of blockchain-based financial products within traditional banking.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.