Bitwise CIO Matt Hougan projects that Bitcoin could reach $6.5 million per coin over the next 20 years, citing ongoing global debt growth, currency debasement, and money printing as key drivers. After a challenging 2025 marked by broad crypto market declines, Hougan describes the current phase as a “rounding bottom,” characterized by muted retail activity and weak ETF flows, while institutional interest continues to grow.

Short-Term Trading Outlook

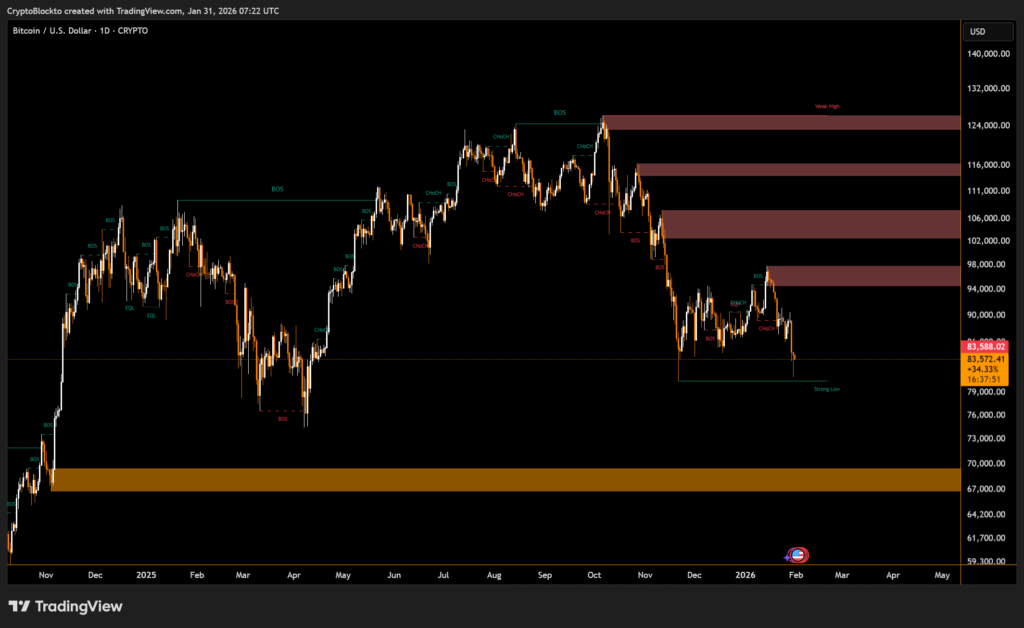

Hougan says to cindesk that Bitcoin to trade sideways between $75,000 and $100,000 in the first half of 2026. Significant selling pressure remains near $100,000, with options-market positioning suggesting patience will be required before the next leg higher. Regulatory clarity and macroeconomic stabilization later in the year could trigger a stronger upward trend.

Long-Term Adoption and Institutional Interest

Central banks are increasingly exploring Bitcoin but adoption is expected over a 10- to 20-year horizon. Meetings with multiple central banks indicate ongoing evaluation of Bitcoin’s security and risk profile. Hougan highlights the cryptocurrency’s role as a superior form of self-custody and settlement, drawing parallels to gold.

Declining volatility and expanding financial products such as ETFs, stablecoins, and tokenized assets are expected to support institutional adoption. Hougan concludes that fundamentals remain strong, setting the stage for a constructive 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.