Bitcoin’s recent price decline has triggered a notable shift in derivatives markets, where bets on further downside are now rivaling long-standing bullish wagers. As the cryptocurrency slid to multi-month lows, traders moved aggressively to hedge against additional losses, reshaping the options landscape.

Put Options Rival Bullish $100,000 Bets

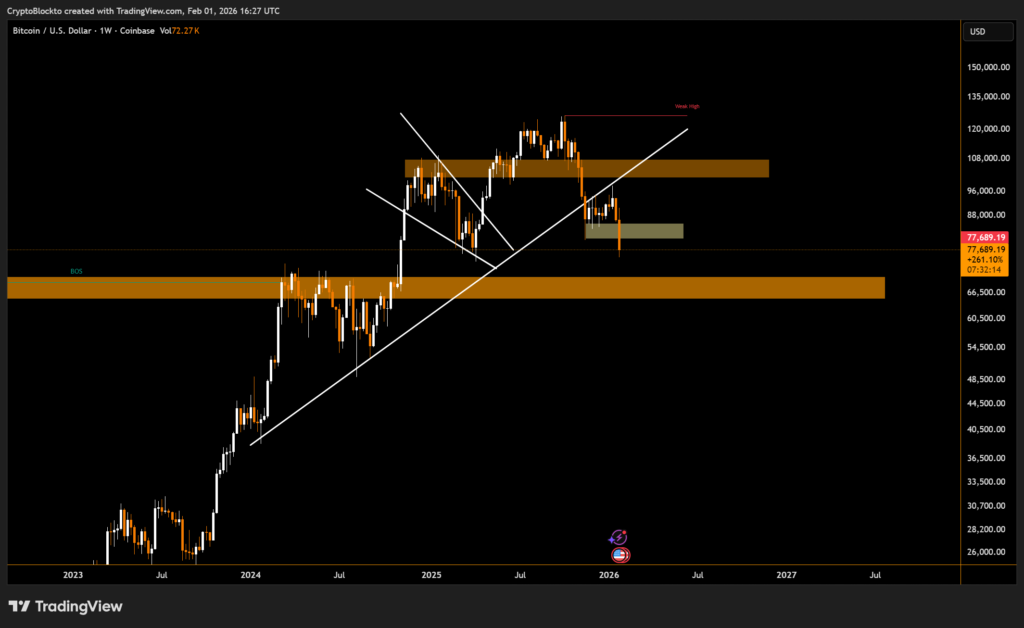

Bitcoin has fallen nearly 10% over the past week, dipping below the $78,000 level and unsettling market sentiment. In response, demand for put options — contracts that gain value if prices fall — has surged. The $75,000 put has emerged as the most actively traded bearish position, with notional open interest climbing to roughly $1.16 billion.

This figure now closely matches the open interest in the widely watched $100,000 call option, a long-time favorite among traders betting on a renewed rally into six-figure territory. The parity between these two strikes highlights a market split between downside protection and optimism for a longer-term rebound.

Sharp Contrast to Earlier Post-Election Optimism

The rise in lower-strike puts marks a clear departure from positioning seen after the US presidential election, when traders overwhelmingly favored high-strike calls. That earlier enthusiasm was driven by expectations of regulatory clarity and a sustained bull run.

Beyond $75,000, substantial interest has also built in puts at $70,000, $80,000, and $85,000. For now, options activity suggests traders are prioritizing risk management as Bitcoin searches for a stable floor.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.