The recent Bitcoin sell-off has pushed aggregate investor returns in the largest spot Bitcoin exchange-traded fund into negative territory, highlighting the impact of the downturn on late-stage inflows. Based on dollar-weighted flow analysis, the average dollar invested in BlackRock’s iShares Bitcoin Trust (IBIT) is now underwater following Bitcoin’s drop into the mid-$70,000 range.

Bitcoin’s decline accelerated over the weekend, erasing gains accumulated during the late-2024 rally. While early investors who entered the fund near launch may still be sitting on profits, heavier capital inflows at higher price levels have dragged overall dollar-weighted returns below zero.

IBIT Performance Reflects Timing of Investor Inflows

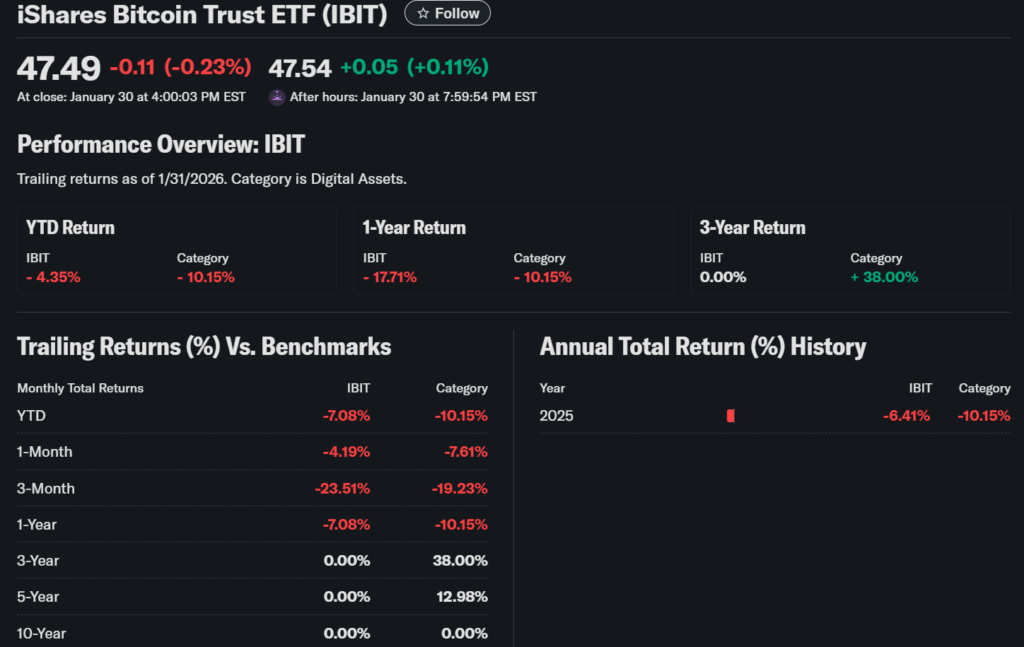

Data tracking cumulative, dollar-weighted performance shows that aggregate gains peaked around October, when Bitcoin was trading near record highs. At that point, IBIT’s dollar-weighted returns reached an estimated $35 billion. Since then, falling prices and sustained volatility have steadily unwound those gains.

IBIT remains one of the fastest-growing ETFs in history, reaching $70 billion in assets under management in record time. However, recent declines in its net asset value mirror Bitcoin’s broader correction, reinforcing how sensitive investor outcomes are to entry timing in volatile markets.

Bitcoin ETF Outflows Accelerate

The shift into negative territory comes alongside accelerating outflows from Bitcoin investment products. In the week ending Jan. 25, Bitcoin-focused funds recorded nearly $1.1 billion in net withdrawals, contributing to total crypto fund outflows of approximately $1.73 billion. Reduced expectations for interest rate cuts and weakening price momentum have weighed heavily on investor sentiment, particularly in the United States.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.