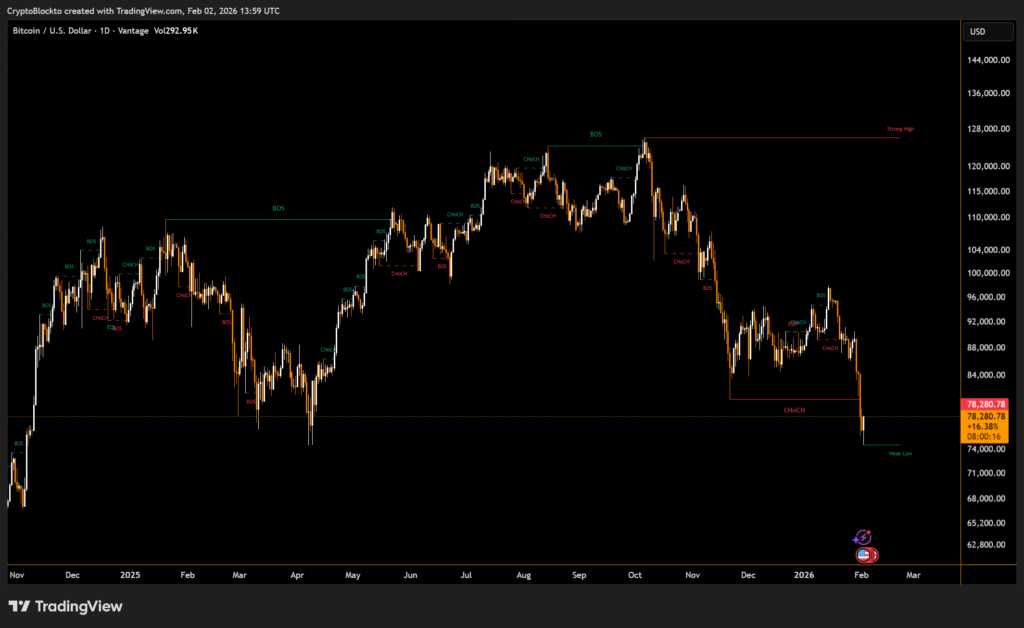

Binance has begun converting its $1 billion Secure Asset Fund for Users (SAFU) into Bitcoin, starting with an initial $100 million purchase. The move comes during a period of heightened market volatility, with Bitcoin recently dipping below key price levels. The decision signals a strategic shift in how the exchange manages its long-standing user protection reserve.

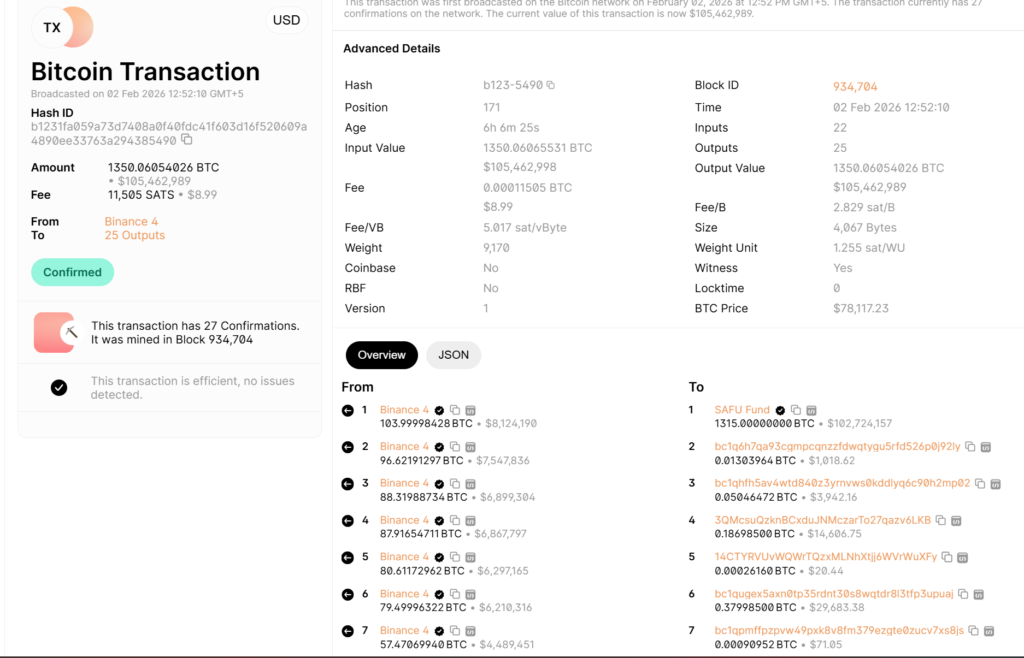

The exchange acquired approximately 1,315 BTC at an average price near $77,400 per coin, bringing the total value of the purchase to just over $100 million. This marks the first phase of a broader plan to move the entire SAFU reserve into Bitcoin over the coming weeks.

Shift From Stablecoins to Bitcoi

SAFU, established in 2018 and funded through trading fees, was originally held in stablecoins to maintain dollar-pegged stability. After transitioning from BUSD to USDC last year, Binance has now opted to fully exit stablecoins for this fund, reallocating all reserves into Bitcoin.

According to the exchange, SAFU will continue to function as an emergency backstop for users in the event of extreme incidents, despite the increased price volatility associated with holding BTC.

Roughly $900 million remains earmarked for additional Bitcoin purchases as part of the conversion plan. The move coincides with a broader market downturn that briefly pushed Bitcoin below $75,000, prompting renewed “buy-the-dip” activity across the industry.

Binance’s decision underscores growing institutional confidence in Bitcoin as a long-term reserve asset, even amid short-term market uncertainty.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.