US President Donald Trump’s decision to nominate former Federal Reserve governor Kevin Warsh as the next Fed chair has introduced uncertainty across financial markets, including Bitcoin and other risk assets. While Warsh is viewed as supportive of lower interest rates, analysts warn his stance on monetary liquidity could weigh on broader market conditions.

Kevin Warsh Fed Nomination and Bitcoin Outloo

Warsh’s appointment could allow the Federal Reserve to continue moving toward interest rate cuts. Lower rates generally ease borrowing conditions and can support demand for assets such as Bitcoin, equities, and high-growth investments.

However, analysts caution that interest rate policy alone may not be enough to fuel a sustained recovery in crypto markets if liquidity remains constrained.

US Liquidity Concerns Take Center Stage

Warsh has previously expressed concerns that the Federal Reserve’s balance sheet is significantly larger than necessary. This suggests limited appetite for policies such as quantitative easing, which inject liquidity into markets through large-scale bond purchases.

This approach points to a stabilization of liquidity rather than meaningful expansion an environment that may limit upside for Bitcoin despite favorable rate expectations.

Crypto markets recently shed roughly $250 billion in total market value amid a broader sell-off affecting stocks and precious metals. Analysts attributed the decline primarily to tightening liquidity conditions rather than crypto-specific developments.

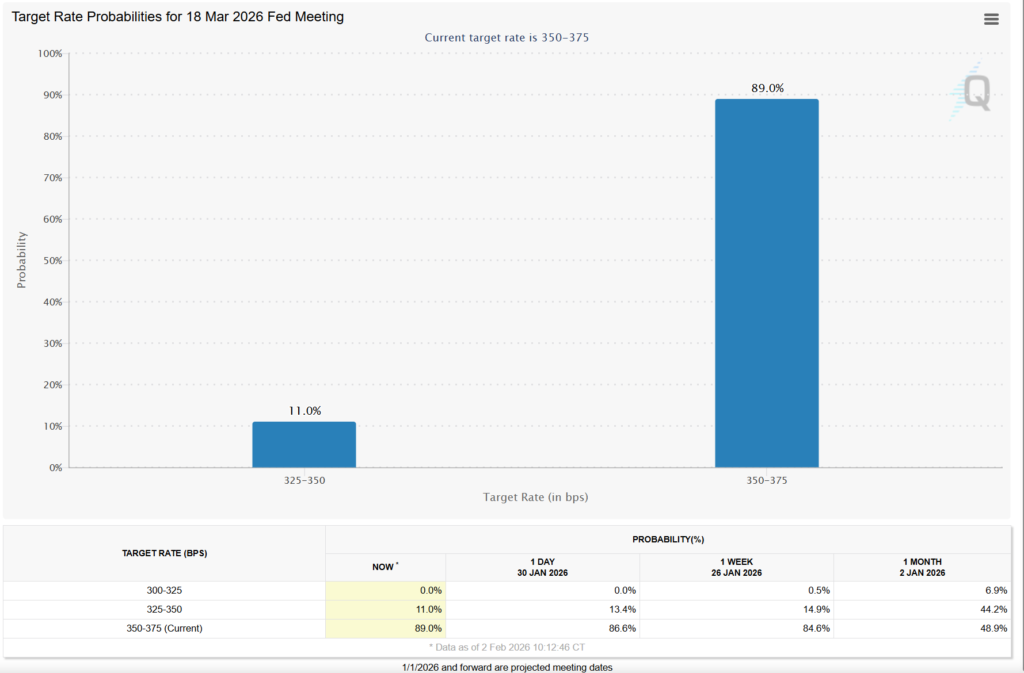

Interest rate expectations remain largely unchanged, with most market participants anticipating steady rates at the next policy meeting and a potential cut later in the year. The balance between rate policy and liquidity management will remain a key factor shaping Bitcoin’s trajectory in the months ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.