Ark Invest increased its holdings in several crypto-related companies as market volatility pushed share prices lower, signaling continued confidence in the long-term outlook for digital assets. The purchases come amid a broader downturn across both cryptocurrency markets and publicly listed firms tied to the sector.

Ark Invest Buys Circle, Bitmine, and Bullish Shares

Recent trade disclosures show Ark Invest added approximately $9.4 million worth of shares in Circle across two exchange-traded funds. The firm also invested around $6.25 million in Ethereum treasury company Bitmine and about $6 million in shares of the Bullish crypto exchange.

In addition to these larger positions, Ark increased smaller stakes in Coinbase and Block Inc., committing a combined total of roughly $3.1 million. The buying activity suggests Ark is taking advantage of discounted valuations following sustained price declines.

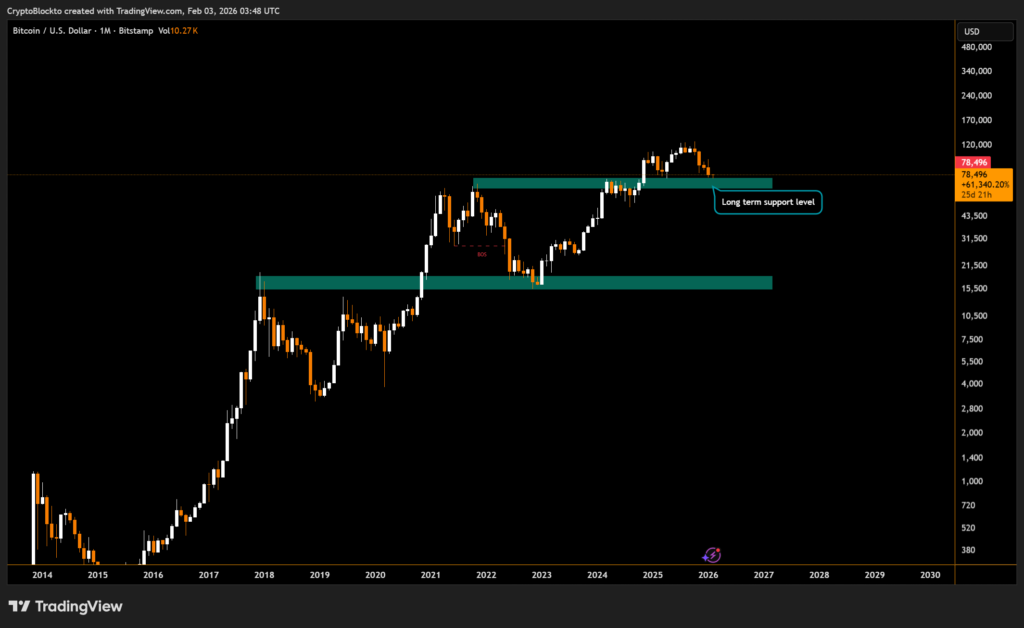

Cathie wood has pointed to historical market patterns, suggesting that recent strength in gold prices may precede renewed momentum in Bitcoin. While correlations remain modest, past cycles show gold rallies have often led major advances in the crypto market.

Crypto Stocks Reflect Market Weakness

The purchases followed notable drops in crypto-linked equities. Circle shares closed nearly 8% lower in the latest session and remain down roughly 65% over the past six months. Bitmine and Bullish also recorded single-day declines, while Coinbase fell more than 3%.

These stock movements mirror weakness across the broader digital asset market. Bitcoin recently traded near $78,600 after falling close to 11% over the past week, while Ether declined about 20% to roughly $2,330.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.