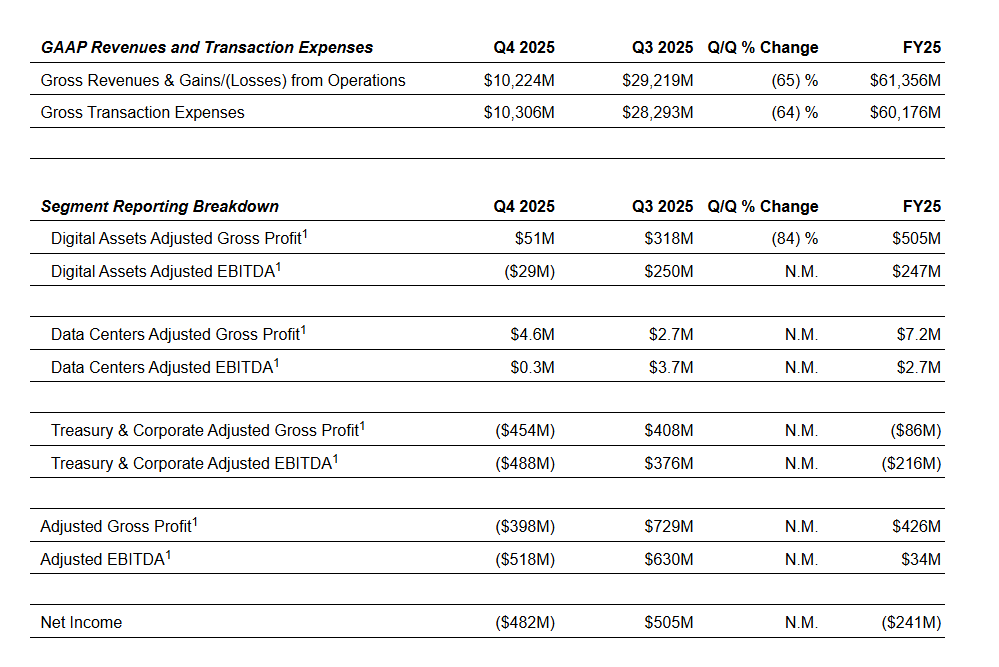

Galaxy Digital reported a net loss of $482 million in the fourth quarter of 2025, contributing to a full-year net loss of $241 million, as weaker digital asset prices weighed heavily on its balance sheet. The company said fourth-quarter results were primarily affected by falling cryptocurrency valuations, with Bitcoin declining roughly 20% during the period.

For the full year, Galaxy attributed its losses to a combination of lower digital asset prices and approximately $160 million in one-time costs. Management noted that market conditions in late 2025 reflected a broader downturn across major cryptocurrencies, including Bitcoin, Ethereum, and Solana.

Profitability Metrics and Balance Sheet Strength

Despite the reported losses, Galaxy posted an adjusted gross profit of $426 million for the year. The company ended 2025 with $2.6 billion in cash and stablecoins, providing liquidity amid ongoing market volatility. Total platform assets stood at $12 billion, while the asset management division recorded $2 billion in net inflows over the year.

Alongside its digital asset operations, Galaxy continued to expand its artificial intelligence infrastructure strategy. The company confirmed progress on its Texas-based data center project, which received approval for an additional 830 megawatts of power capacity in January. This brought total approved capacity to more than 1.6 gigawatts.

Following the earnings release, Galaxy shares declined about 15% in Tuesday trading, reflecting investor reaction to the quarterly loss despite ongoing expansion efforts and balance sheet strength.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.