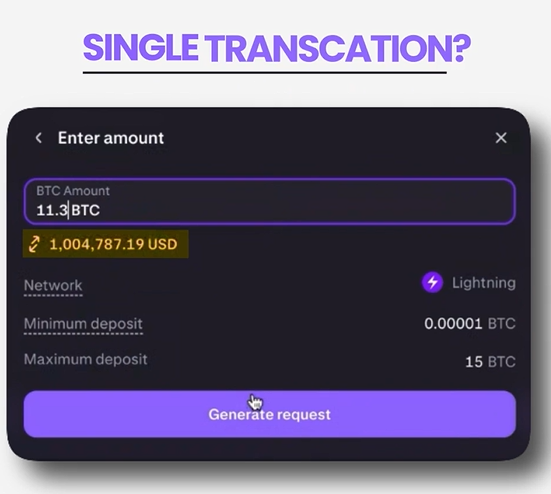

A recent $1 million Bitcoin payment completed over the Lightning Network has marked a major milestone for institutional use of Bitcoin’s scaling technology. The transaction demonstrated that Lightning can reliably process seven-figure transfers between regulated entities, challenging the perception that the network is limited to small retail payments.

Record Lightning Transaction Sets Benchmark

The transfer, completed in under half a second, moved funds between an institutional trading desk and a major cryptocurrency exchange using enterprise-grade Lightning infrastructure. It stands as the largest publicly disclosed single Lightning payment to date, far exceeding earlier reported transactions that rarely crossed the six-figure mark. The successful routing relied on managed node services, pre-provisioned liquidity, and uptime guarantees designed for professional trading environments.

Lightning Network Capacity and Adoption Trends

While Lightning Network capacity has fluctuated in recent years, overall growth remains notable. Public channel capacity dipped in mid-2025 before rebounding to a new all-time high of more than 5,600 BTC by year’s end. Despite this progress, most Lightning activity still consists of smaller payments, with only a handful of platforms gradually raising transaction and channel limits.

Institutional Interest Continues to Build

Financial firms and infrastructure providers increasingly view Lightning as a viable settlement layer. Research published in 2025 highlighted a multi-year increase in average network capacity and pointed to benefits such as faster settlement, lower fees, and reduced on-chain congestion. Recent software upgrades focused on latency reduction and enterprise support further reinforce Lightning’s growing role in institutional Bitcoin payments.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.