Strategy reported a net loss of $12.4 billion in the fourth quarter of 2025, largely driven by a sharp downturn in Bitcoin prices. The company’s stock reacted quickly, closing 17% lower as the cryptocurrency market continued its volatile slide.

Bitcoin Price Drop Hits Strategy’s Balance Sheet

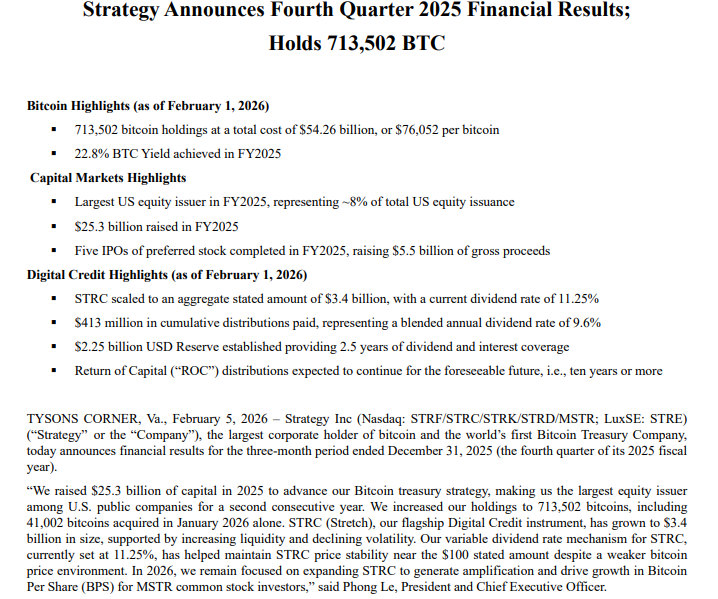

Bitcoin fell 22% during the fourth quarter, sliding from a peak near $126,000 in October to below $88,500 by year-end. The decline extended into early 2026, with Bitcoin down roughly 30% year to date, trading near $64,500. This places the asset below Strategy’s average purchase price of $76,052 per Bitcoin, leaving the firm down about 17.5% on its holdings.

Strategy currently holds 713,502 Bitcoin, making it one of the largest corporate holders globally.

Revenue Growth Despite Market Weakness

Despite the substantial loss, Strategy’s Q4 revenue rose 1.9% year over year to $123 million, supported by steady performance in its business intelligence operations. The company also strengthened its liquidity position, ending the quarter with $2.25 billion in cash, enough to cover approximately 30 months of dividend commitments.

Management emphasized that the company faces no immediate financial strain. With no significant debt maturities until 2027 and $8.2 billion in convertible debt, Strategy’s net leverage stands near 13%, below many large-cap peers. Executives reiterated confidence in the firm’s long-term Bitcoin-focused strategy despite near-term market pressure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.