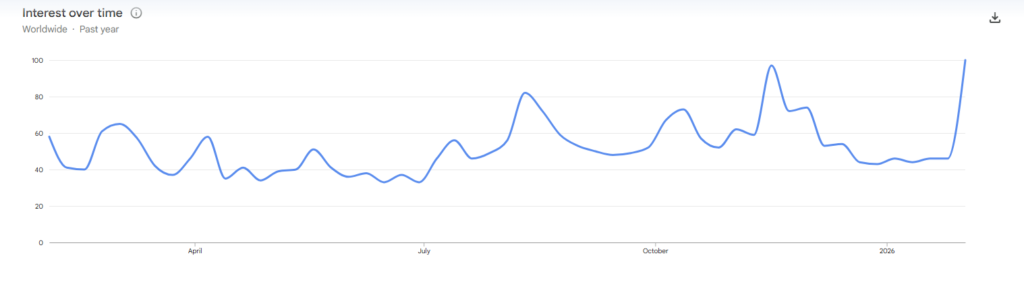

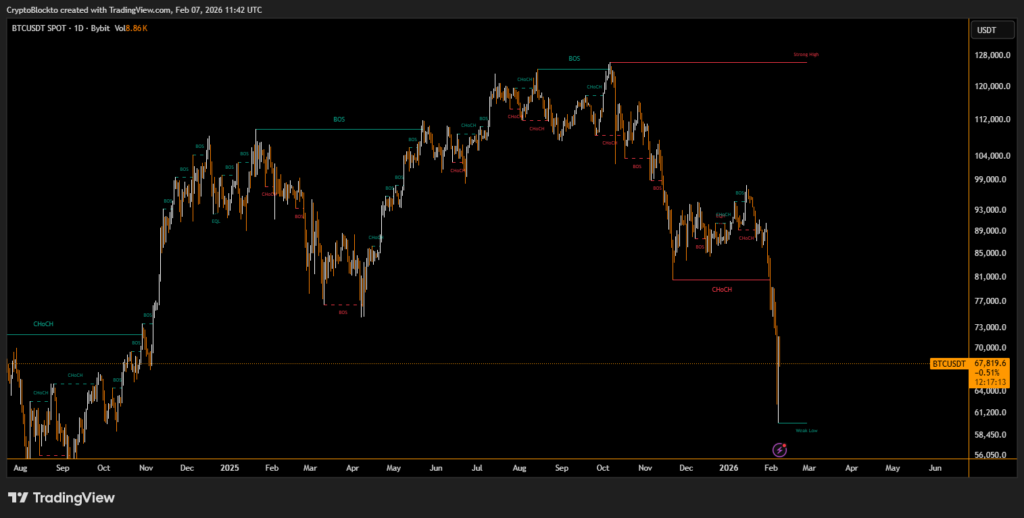

Online interest in Bitcoin has surged sharply as dramatic price swings push the cryptocurrency back into the public spotlight. Data from Google Trends shows a spike in searches for the term “Bitcoin” during the first week of February, coinciding with a steep market sell-off and subsequent rebound.

Bitcoin Price Swings Drive Search Interest

Worldwide Google search activity for “Bitcoin” reached its highest level in the past year, hitting a score of 100 during the week starting Feb. 1. This surge followed a rapid decline in Bitcoin’s price from roughly $81,500 to near $60,000 in a matter of days, marking its lowest level since October 2024. The asset later recovered to around $70,700, but remained down more than 15% over the week.

Search trends are often used as a proxy for retail participation, as spikes typically occur during periods of heightened volatility rather than quiet consolidation.

Signs of Returning Retail and Mixed Sentiment

Some analysts interpret the rise in search volume as an early signal of renewed retail engagement. Market observers have noted that sharp pullbacks historically draw attention from individual investors looking for potential entry points.

Despite growing interest, broader sentiment indicators paint a cautious picture. The Crypto Fear & Greed Index recently dropped to an “Extreme Fear” reading of 6, a level not seen since mid-2022. While such conditions suggest anxiety remains high, some traders argue that extreme pessimism has historically aligned with longer-term buying opportunities.

The combination of rising public interest and elevated fear underscores the uncertain but closely watched state of the Bitcoin market.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.