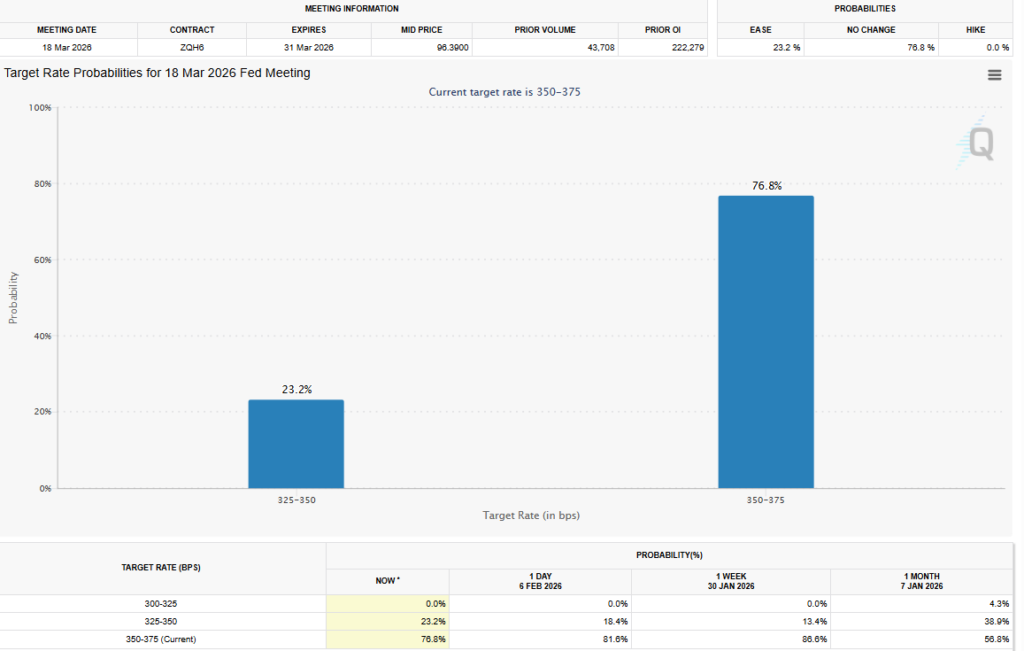

Expectations for a US interest rate cut at the upcoming March Federal Open Market Committee (FOMC) meeting are rising, with more than 23% of traders now pricing in a reduction. This marks a notable increase from late last week, when fewer than one in five market participants anticipated a cut.

Rate Cut Probabilities Shift Higher

Derivatives data shows that traders expecting a policy change are largely aligned around a modest move. Current pricing reflects expectations for a 25 basis point cut, while forecasts for a larger reduction remain absent. The shift suggests growing concern that current financial conditions may be tighter than previously assumed.

Federal Reserve Leadership Concerns Weigh on Markets

Investor sentiment has been influenced by uncertainty surrounding the Federal Reserve’s future leadership. The nomination of Kevin Warsh to replace the current Fed chair has prompted debate across financial markets. Warsh is widely viewed as favoring stricter monetary policy, including a smaller central bank balance sheet.

This perception has unsettled investors who had expected a more accommodative policy path in the months ahead. Late January and early February saw increased volatility across asset classes as markets reassessed liquidity expectations.

Implications for Risk Assets and Crypto Markets

Interest rate policy plays a significant role in shaping demand for risk assets. Lower rates typically support liquidity and borrowing, while higher rates can restrict capital flows. The mixed signals surrounding future Fed policy have left investors cautious, particularly in markets sensitive to shifts in liquidity and credit conditions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.