The US Commodity Futures Trading Commission has expanded its definition of eligible payment stablecoin issuers, formally recognizing national trust banks under updated regulatory guidance. The move reflects evolving federal oversight following the implementation of a comprehensive stablecoin framework in the United States.

Updated Stablecoin Criteria Under Revised CFTC Guidance

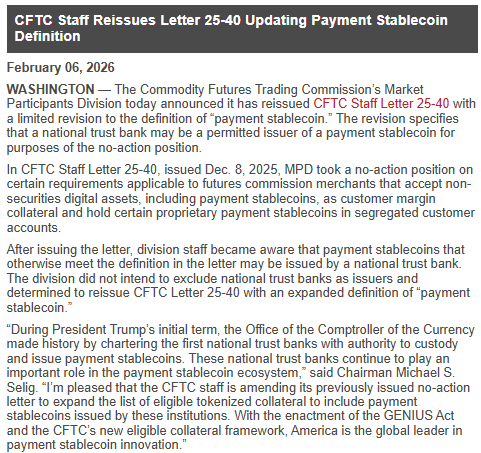

The CFTC reissued a revised staff letter to clarify that national trust banks qualify as permitted issuers of payment stablecoins. These institutions operate nationwide and primarily provide custodial, fiduciary, and asset management services rather than traditional retail banking products such as loans or checking accounts.

Regulators stated that the earlier guidance was not intended to exclude national trust banks and that the updated definition better aligns with current law. By expanding eligibility, the CFTC is signaling broader acceptance of regulated financial entities participating in stablecoin issuance.

GENIUS Act Shapes Stablecoin Regulation

The revised guidance aligns with the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which established clear rules for dollar-pegged digital tokens. The framework limits recognized stablecoins to those fully backed on a one-to-one basis by cash deposits or short-term government securities.

Under the law, issuers must meet strict standards around redemption rights, reserve transparency, and financial stability. Algorithmic and synthetic stablecoins remain excluded.

Broader Implications for the US Stablecoin Market

The update follows related efforts by banking regulators to outline pathways for banks to issue stablecoins through regulated subsidiaries. Together, these developments suggest increasing regulatory clarity and a growing role for traditional financial institutions in the stablecoin ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.