A growing divide has emerged among leading crypto venture capitalists over whether non-financial Web3 applications have failed or are simply waiting for the right conditions to scale.

Disagreement on Product-Market Fit in Web3

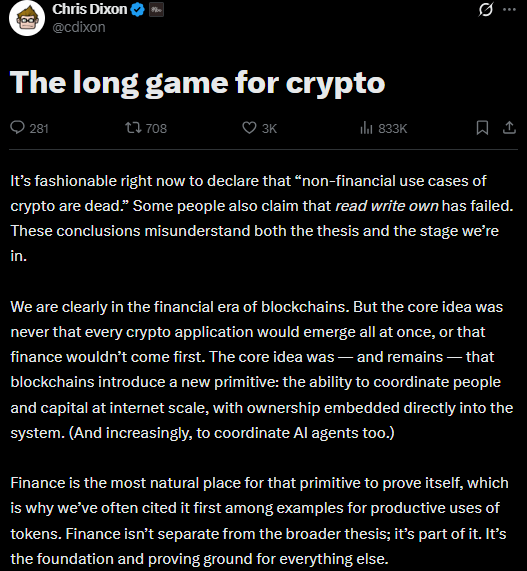

The debate was reignited after comments from Chris Dixon, a managing partner at a16z crypto, who argued that non-financial blockchain use cases have been held back by years of regulatory pressure, scams and short-term extractive behavior. Dixon suggested that once regulatory clarity improves, applications such as decentralized social networks, digital identity systems, creator platforms and Web3 gaming could gain meaningful adoption.

Not all investors agree. Haseeb Qureshi of Dragonfly countered that these products failed because users did not want them, arguing that weak demand and poor execution — not regulation — were the primary reasons they never achieved scale. In his view, markets already delivered a clear verdict.

Time Horizons and Investment Strategy Divide

The discussion also exposed differences in venture capital strategy. Dixon emphasized long investment horizons, noting that building entirely new digital ecosystems can take a decade or more. Others pushed back, pointing out that most venture funds operate within much shorter deployment cycles, requiring clearer traction earlier on.

Data continues to show that financial use cases dominate crypto adoption. The highest-fee-generating applications remain exchanges, stablecoins and decentralized finance protocols. Recent venture funding trends reinforce this reality, with most capital in 2025 flowing toward tokenized real-world assets and financial infrastructure rather than consumer-facing Web3 applications.

The clash highlights an unresolved question for the industry: whether non-financial crypto use cases are early—or already obsolete.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.