The US Federal Reserve is moving into a phase of steady, incremental monetary expansion rather than an aggressive return to large-scale stimulus, according to economist Lyn Alden, who argues the distinction between easing and printing is largely semantic.

Fed Policy Points to Ongoing Monetary Expansion

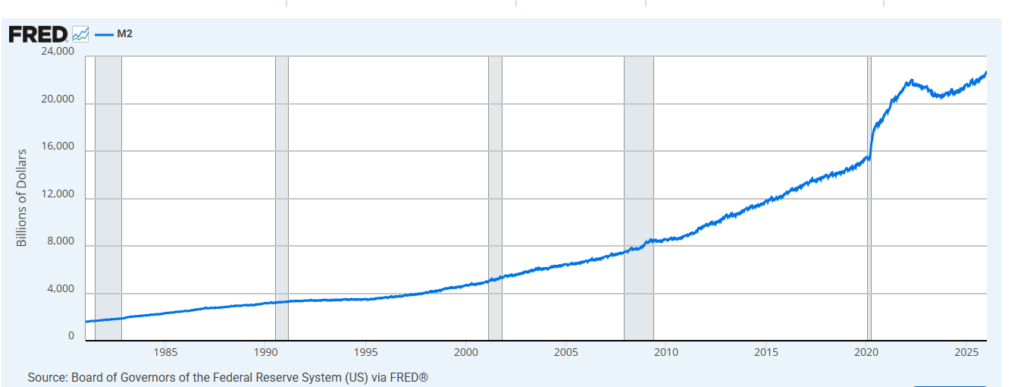

In her latest investment outlook, Alden said her baseline expectation aligns closely with the Federal Reserve’s own projections. She anticipates the central bank will expand its balance sheet broadly in line with nominal GDP growth and total banking system assets. While this approach lacks the intensity of past stimulus cycles, Alden believes it still represents a long-term debasement of currency purchasing power.

As a result, she continues to favor scarce, high-quality assets while avoiding areas of excessive speculation. Alden emphasized disciplined rebalancing toward under-owned sectors rather than chasing euphoric market trends.

Rate Cut Expectations Remain Muted

Market expectations suggest limited near-term policy easing. Fewer than one in five traders currently anticipate an interest rate cut at the March Federal Open Market Committee meeting, reflecting persistent uncertainty around inflation and labor market risks.

Federal Reserve Chair Jerome Powell has acknowledged this tension, noting that inflationary pressures remain elevated while employment risks are rising. This balance complicates the path forward for policymakers.

Leadership Transition Adds Uncertainty

Uncertainty has also increased following the nomination of Kevin Warsh as the next Federal Reserve chair. Viewed as more hawkish on interest rates, Warsh’s potential appointment has added to investor caution as markets look ahead to policy direction in 2026.

Despite the absence of aggressive stimulus, Alden argues the broader trajectory remains clear: gradual monetary expansion is likely to continue shaping asset prices over time.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.