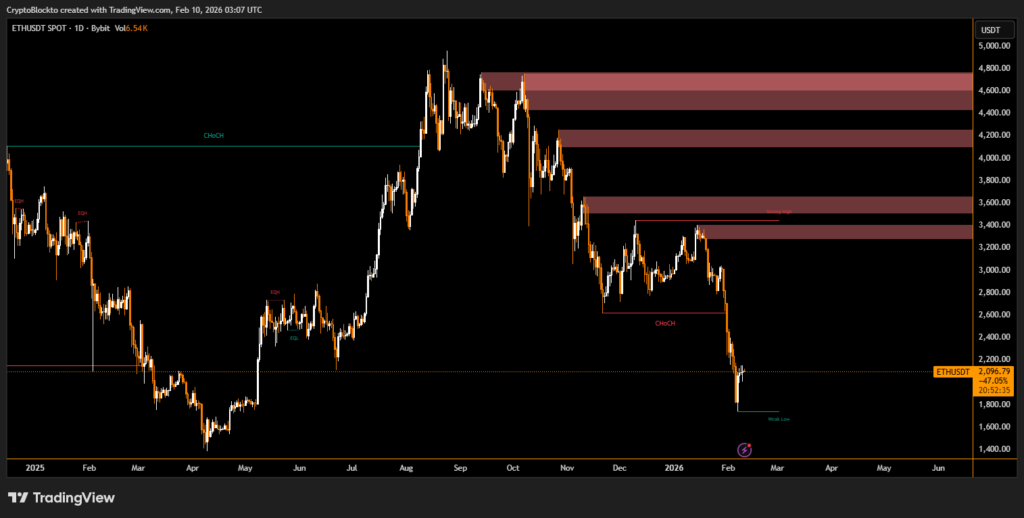

Ethereum has climbed back above the $2,100 level after a sharp sell-off earlier this month, tracking a broader rebound across cryptocurrency markets and US equities. The recovery followed a steep nine-day decline that saw ETH fall to around $1,750, marking its lowest level since April 2025. While prices have staged a short-term bounce, market data suggests traders remain cautious about calling a definitive bottom.

ETH Price Recovery Fails to Shift Derivatives Sentiment

Despite the rebound, Ethereum derivatives markets continue to signal limited confidence. Monthly ETH futures are trading at roughly a 3% annualized premium over spot prices, below the level typically associated with neutral or bullish positioning. This indicates that professional traders are not yet increasing leveraged long exposure, even after the recent pullback.

Ethereum Network Activity and Inflation Concerns

Onchain data shows Ethereum still dominates the sector in total value locked, accounting for more than half of all blockchain deposits when combined with major layer-2 networks. However, slowing base-layer activity has reduced fee revenue, weakening ETH’s burn mechanism. As a result, Ethereum’s supply growth has turned positive, with annualized inflation rising to about 0.8% over the past month.

Layer-2 Strategy Under Review

Ethereum’s reliance on layer-2 scaling solutions has also drawn scrutiny. While these networks expand capacity, they contribute less directly to base-layer fees. With macroeconomic uncertainty and subdued risk appetite, traders appear unconvinced that Ethereum can sustain a strong rally until network activity and broader market confidence improve.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.