Chainlink co-founder Sergey Nazarov believes the current crypto market downturn stands apart from previous bear cycles, arguing that recent events reveal a more mature and resilient industry.

No Major Institutional Failures Despite Market Losses

The total cryptocurrency market capitalization has declined roughly 44% from its October peak of $4.4 trillion, wiping out nearly $2 trillion in value within four months. Despite the scale of the drawdown, Nazarov points out that the market has avoided the kind of large-scale institutional collapses seen in earlier cycles.

Unlike 2022, when high-profile failures triggered systemic risk across the sector, the latest downturn has not been accompanied by widespread risk management breakdowns. According to Nazarov, this suggests that infrastructure, custody standards, and operational controls across the industry have improved significantly.

Real-World Asset Tokenization Continues to Expand

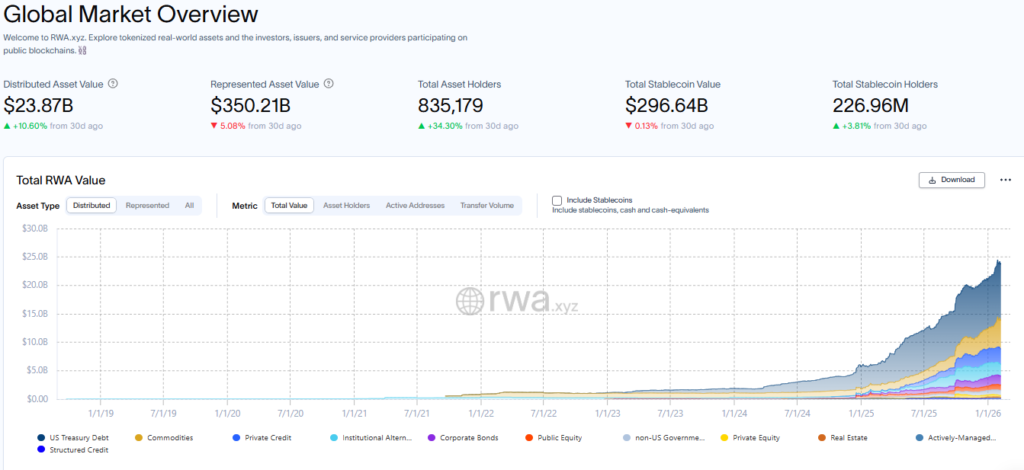

A second factor distinguishing this cycle is the continued growth of tokenized real-world assets. Onchain data shows the total value of tokenized RWAs has increased by approximately 300% over the past year, even as crypto prices declined.

This trend indicates that asset tokenization and onchain derivatives tied to traditional commodities are developing independently of speculative market cycles. Nazarov argues that these use cases provide tangible utility, including continuous market access, transparent collateral, and real-time settlement.

If current trends persist, Nazarov expects onchain real-world assets to eventually exceed cryptocurrencies in total industry value, signaling a fundamental shift in how blockchain technology is used and adopted.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.