US spot Bitcoin exchange-traded funds continued their rebound this week, signaling a potential stabilization in institutional demand after months of sustained outflows. Fresh inflows arrived as Bitcoin prices hovered near the $70,000 level, easing concerns that large investors were exiting the market entirely.

Bitcoin ETF Inflows Show Signs of a Turnaround

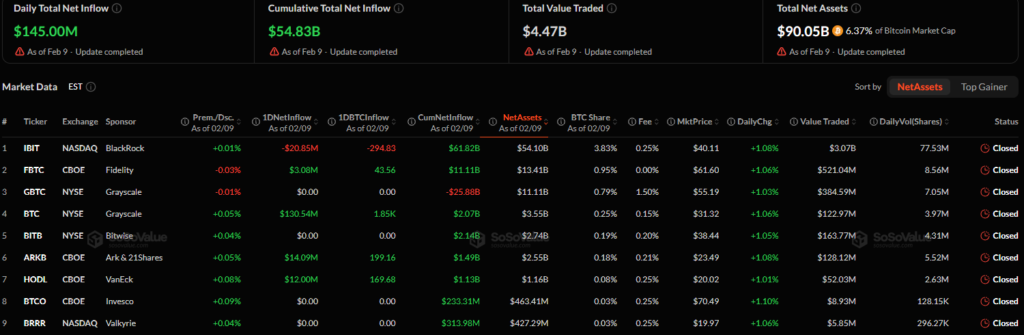

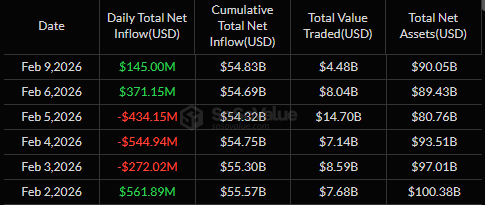

Spot Bitcoin ETFs recorded approximately $145 million in net inflows on Monday, following a much stronger $371 million intake late last week. While cumulative outflows remain significant for the year, the pace of redemptions has slowed noticeably. Market analysts note that similar decelerations in the past have often preceded shifts in investor sentiment.

Despite recent volatility, Bitcoin ETF flows suggest institutions may be reassessing exposure rather than continuing aggressive selling. Analysts have described the current downturn as relatively mild compared with previous bear markets, largely due to the absence of major industry failures.

Early Bitcoin Holders Reduce Exposure Gradually

According to asset managers, long-term Bitcoin holders are not abandoning the market. Instead, many early investors are trimming positions selectively after substantial gains. This behavior contrasts with past cycles where sharp drawdowns triggered widespread capitulation.

The improving sentiment extended beyond Bitcoin. Spot ETFs linked to Ethereum and XRP also recorded net inflows, indicating renewed interest across major digital assets.

Together, the data points to cautious optimism as institutional participation steadies and long-term holders maintain core positions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.