Robinhood shares fell sharply in after-hours trading after the company reported fourth-quarter results that missed Wall Street revenue forecasts, despite posting record overall revenue for the period.

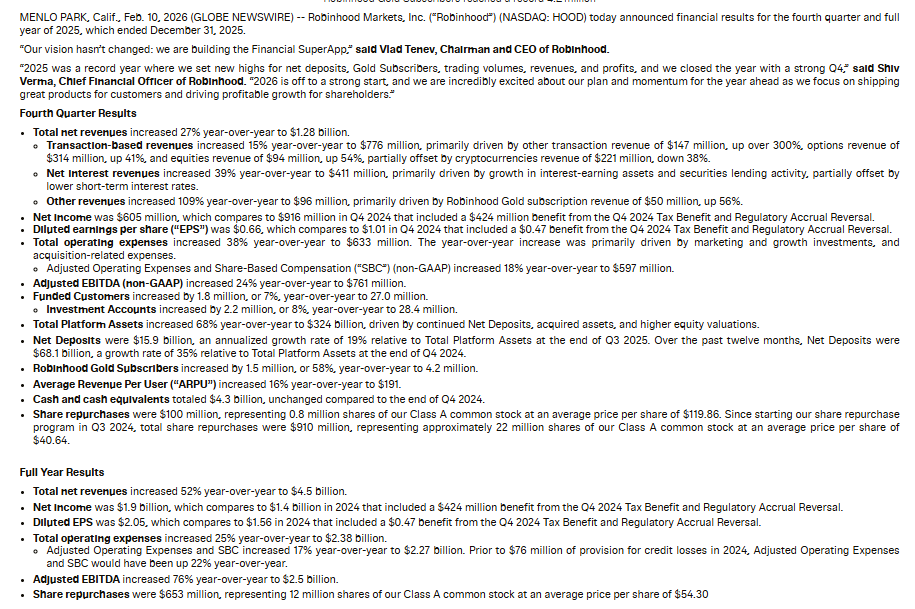

The trading platform generated $1.28 billion in net revenue in Q4, a 27% increase year over year but below analyst expectations of $1.34 billion. The earnings shortfall weighed on investor sentiment, sending shares down 7.66% in extended trading to $79.04 after closing the regular session at $85.60.

Crypto Revenue Declines as Market Slows

Crypto-related revenue dropped 38% compared to the same quarter last year, falling to $221 million. The decline followed a broader downturn in digital asset markets that began in October, which dampened trading activity across the sector.

Robinhood reported net income of $605 million for the quarter, down 34% year over year. However, earnings per share came in at 66 cents, slightly ahead of analyst estimates of 63 cents.

Crypto trading volumes rose just 3% quarter over quarter to $82.4 billion across Robinhood’s app and its subsidiary exchange, Bitstamp. In contrast, equity trading volumes increased 10% to $710 billion, while options contracts climbed 8% to 659 million.

For the full year, Robinhood posted $4.5 billion in revenue, up 52% from the previous year. Annual net income reached $1.9 billion, reflecting a 35% increase.

The company also saw strong growth in alternative transaction-based products, including prediction markets and futures, which generated $147 million in Q4 revenue, up 375% year over year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.