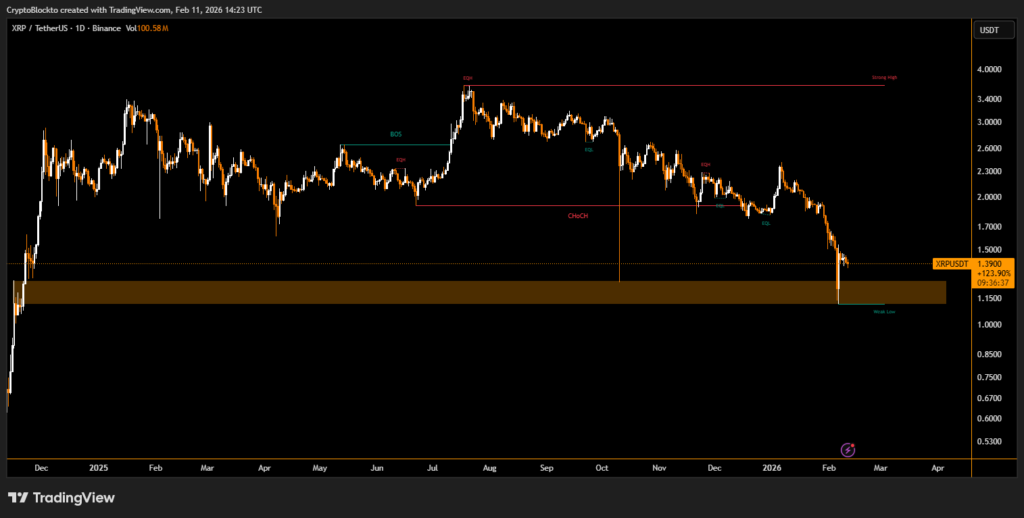

XRP is facing renewed downside pressure after sliding nearly 63% from its multi-year high of $3.66 to trade around $1.40. Recent chart patterns suggest the correction may not be over, with some analysts warning that a move below $1 remains a realistic possibility in the weeks ahead.

Despite technical weakness, on-chain and institutional data present a mixed picture. Spot XRP exchange-traded funds have accumulated approximately $1.23 billion in net inflows since launch, with assets under management surpassing $1 billion. Recent sessions have recorded consecutive daily inflows, suggesting continued institutional interest.

Additional pressure emerged after XRP was rejected near the 200-week moving average around $1.40, reinforcing the short-term bearish outlook.

Institutional Demand and Whale Activity Offer Support

Whale transactions exceeding $100,000 have climbed to four-month highs, while active XRP Ledger addresses surged to 78,727 within an eight-hour period — the strongest reading in six months.

While a corrective retracement below $1 remains possible, sustained inflows and accumulation trends could help stabilize price action if broader market conditions improve.

Santiment said in a recent post on X;

The coming weeks may prove decisive. A break below $1.12 could open the door to deeper support near $0.70, while holding current levels alongside steady ETF inflows may limit further downside. Traders are closely watching whether institutional demand can offset mounting technical pressure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.