Bitcoin’s reputation as “digital gold” is facing renewed scrutiny after fresh research from Grayscale shows its price behavior is increasingly aligned with equities, particularly software stocks. The report notes that while Bitcoin has long been promoted as a hedge against macroeconomic instability, its short-term trading patterns tell a different story.

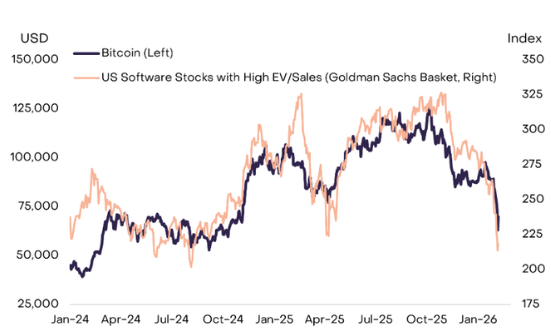

According to the analysis, Bitcoin has not shown a strong correlation with gold or silver in recent months, even as precious metals posted record rallies. Instead, since early 2024, Bitcoin’s price movements have closely tracked software sector equities — a segment recently pressured by concerns that artificial intelligence could disrupt traditional business models.

Institutional Flows and Market Integration Drive Correlation

Grayscale attributes this shift to Bitcoin’s deeper integration into traditional financial markets. Rising institutional participation, increased exchange-traded fund activity, and broader macro risk sentiment have made Bitcoin more sensitive to movements in growth assets.

The crypto has declined roughly 50% from its October peak above $126,000, with multiple waves of selling extending into early 2026. Analysts also pointed to persistent exchange price discounts as evidence of sustained selling pressure.

Long-Term Store of Value Thesis Remains

Despite recent underperformance, Grayscale maintains that Bitcoin’s fixed supply and independence from central banks support its long-term store-of-value thesis. While it has yet to rival gold’s centuries-long monetary role, the firm argues Bitcoin’s evolution is ongoing, particularly as global finance becomes increasingly digitized.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.