The memecoin sector has shed roughly 34% of its total market capitalization over the past month, falling to about $31 billion amid a broader crypto market pullback. Yet blockchain analytics platform Santiment suggests the downturn may reflect a classic capitulation phase rather than a prolonged collapse.

According to Santiment, a growing sense of “nostalgia” and widespread claims that the meme era is over could indicate that sentiment has reached an extreme. Historically, when traders collectively abandon a sector, it often signals a potential contrarian opportunity.

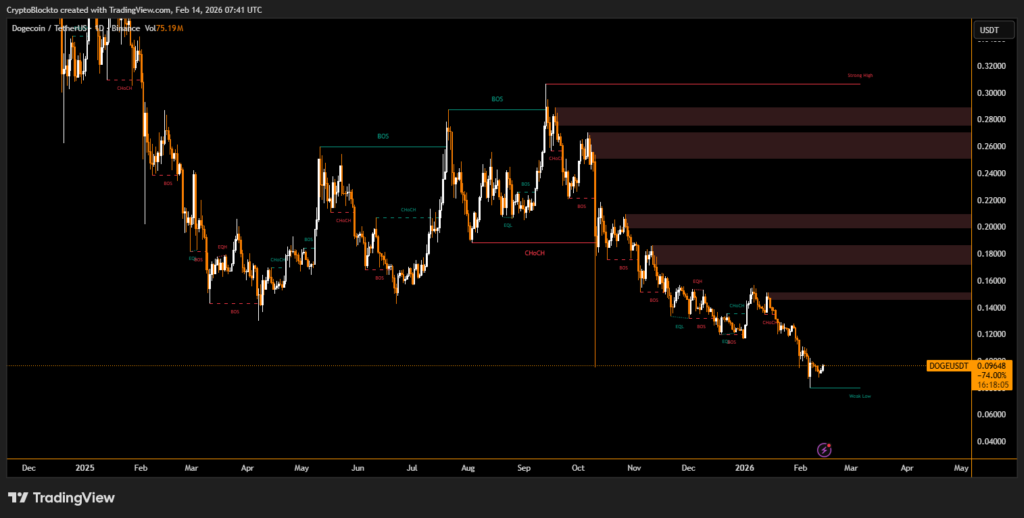

Dogecoin and Leading Memecoins Under Pressure

Dogecoin, often viewed as a bellwether for memecoin momentum, has fallen 32% over the past 30 days. Broader weakness coincided with Bitcoin sliding near $60,000 earlier this month, intensifying risk-off behavior across altcoins.

Among notable tokens, Pippin posted a sharp 243% weekly gain, while Official Trump and Shiba Inu recorded modest advances.

Altcoin Season May Be More Selective

Previous market cycles typically saw capital rotate from Bitcoin to Ethereum and then into higher-risk altcoins. However, analysts now question whether the next altcoin phase will lift all tokens equally.

The bearish commentary currently outweighs bullish sentiment across social media. Historically, markets tend to move against consensus expectations, suggesting that extreme pessimism could precede a stabilization or rebound in the memecoin segment.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.