Bitcoin investors are facing a fresh test of conviction as US inflation shows signs of easing, challenging the core narrative that has long supported the digital asset’s rise.

The Consumer Price Index slowed to 2.4% in January, down from 2.7% in December, indicating cooling price pressures. For many investors, lower inflation reduces the urgency to seek protection in alternative assets. Yet Bitcoin advocates argue that the asset’s long-term appeal goes beyond short-term inflation cycles.

Bitcoin as an Inflation Hedge in a Changing Macro Environment

Bitcoin’s fixed supply of 21 million coins has positioned it as a hedge against currency debasement. The argument remains straightforward: when central banks expand the money supply, fiat currencies tend to lose purchasing power, increasing the relative appeal of scarce assets.

Pompliano said during an interview with Fox Business;

However, with inflation moderating, some holders are reconsidering whether they can maintain long-term exposure without the immediate pressure of rising consumer prices. Despite this shift, supporters maintain that structural monetary risks remain unresolved.

Bitcoin Market Sentiment and Price Performance

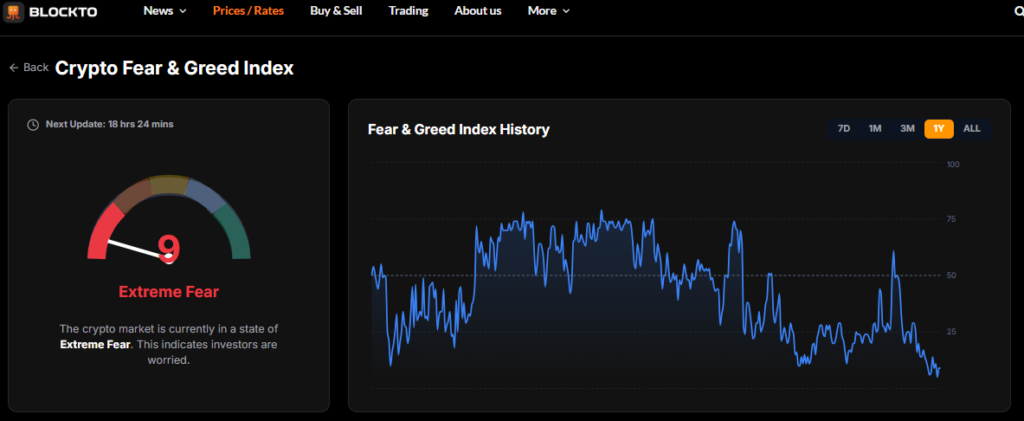

Market sentiment reflects growing caution. The Crypto Fear & Greed Index recently fell to an “Extreme Fear” reading of 9, its lowest level in years. Bitcoin is trading near $68,850, marking a decline of more than 28% over the past 30 days.

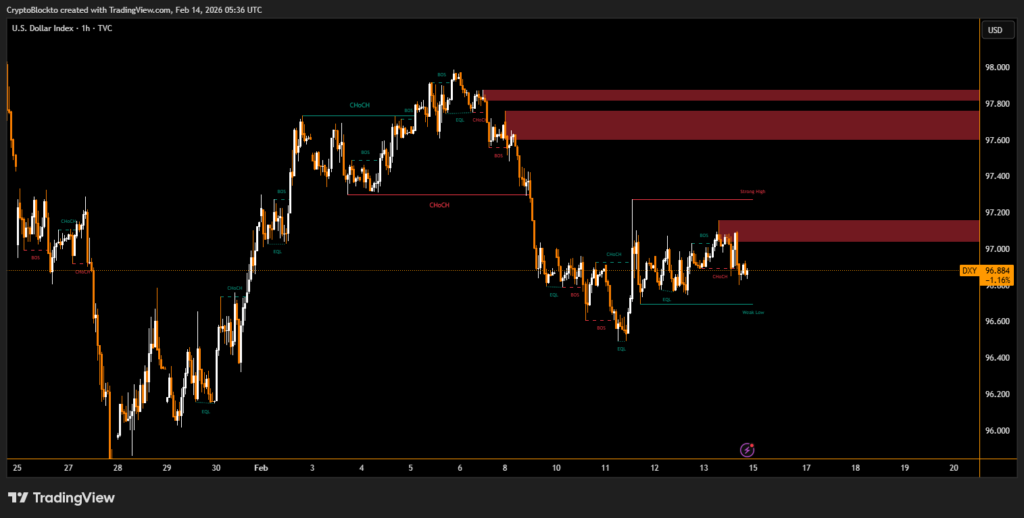

Meanwhile, the US Dollar Index has slipped 2.32% to 96.88, suggesting underlying currency weakness. Some analysts argue that short-term deflationary forces could temporarily mask broader monetary expansion, potentially setting the stage for renewed volatility across risk assets, including Bitcoin.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.