Blockchain technology could transform how governments distribute social benefits, according to Julie Myers Wood, CEO of Guidepost Solutions. She argues that programs still relying on traditional administrative systems should evaluate digital alternatives that offer faster delivery and improved transparency.

Marshall Islands UBI Program and Tokenized Debt Initiative

Republic of the Marshall Islands recently launched a Universal Basic Income program distributing quarterly payments through mobile wallets. The government also issued USDM1, a tokenized bond backed one-to-one by short-term US Treasuries. Guidepost Solutions advised on regulatory compliance and sanctions frameworks for the initiative.

Officials say onchain systems can create auditable records for both benefit distribution and public debt instruments, reducing settlement delays and transaction costs typically associated with legacy financial infrastructure.

Compliance Risks in Tokenized Government Bonds

Despite efficiency gains, compliance remains a central challenge. Anti-money laundering and know-your-customer requirements must be integrated into tokenized systems to prevent misuse and ensure funds reach eligible recipients.

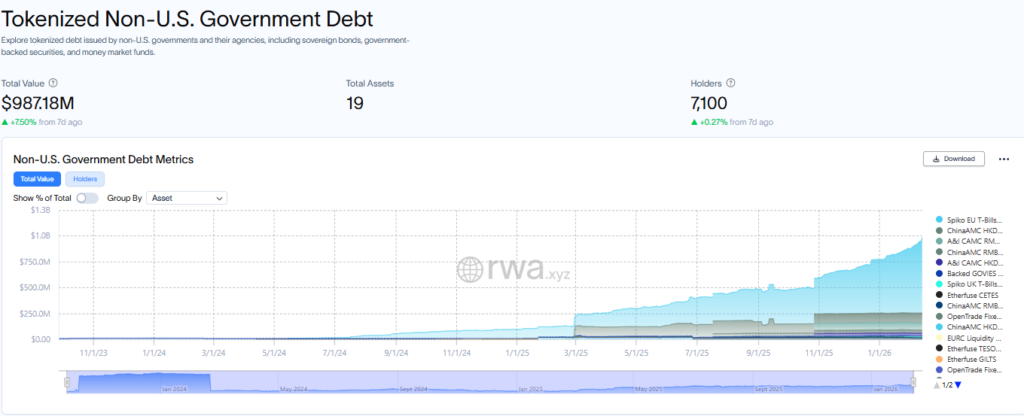

The broader market for tokenized US Treasury products has grown sharply since 2024, reflecting rising institutional interest. Industry forecasts suggest the tokenized bond sector could scale significantly as governments seek cost reductions, asset fractionalization and expanded financial access through blockchain-based infrastructure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.