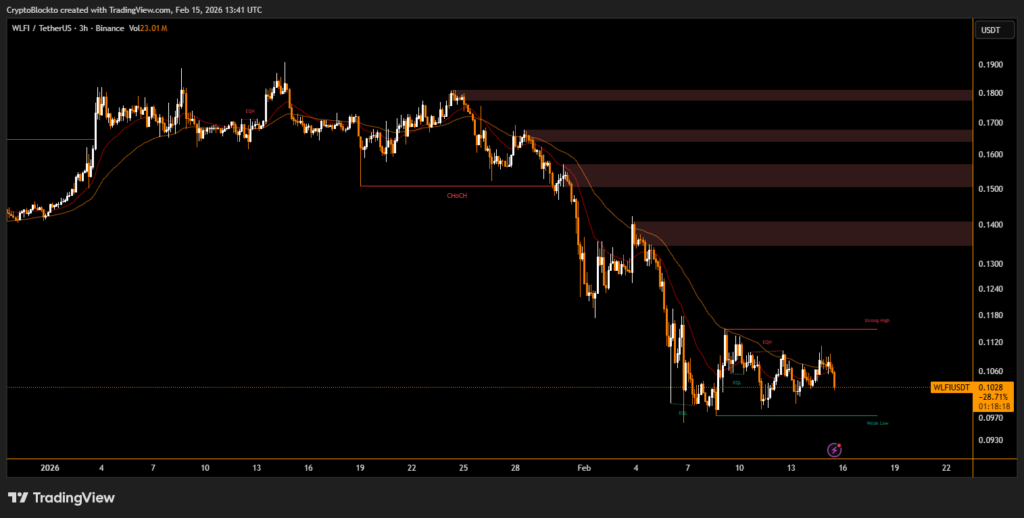

A recent market analysis suggests that World Liberty Financial Token (WLFI), a DeFi governance asset linked to the Trump family, showed signs of stress hours before a sweeping crypto market liquidation wiped out nearly $6.93 billion in leveraged positions.

On Oct. 10, 2025, Bitcoin was trading close to $121,000 when WLFI began to decline sharply. According to the data, the token’s drop started more than five hours before the broader market breakdown. Within a short window, Bitcoin fell around 15%, Ether dropped roughly 20%, and several smaller tokens plunged as much as 70%.

WLFI Volume Surge and Funding Rates Raised Red Flags

WLFI’s hourly trading volume surged to approximately $474 million — nearly 22 times its typical level — just minutes after tariff-related political news became public. The speed of the reaction suggests coordinated or prepared positioning rather than retail-driven momentum.

Extreme Leverage in WLFI Perpetual Futures

Funding rates on WLFI perpetual futures climbed to about 2.87% every eight hours, implying an annualized borrowing cost near 131%. Such elevated funding levels reflect aggressive leveraged positioning, increasing the risk of forced liquidations.

Many trading platforms allow alternative tokens to serve as collateral for leveraged positions. As WLFI’s value dropped, collateral strength weakened, forcing traders to liquidate major assets such as Bitcoin and Ether to maintain margin requirements. This cascade intensified selling pressure and accelerated market-wide liquidations.

Market Structure and Early Stress Signals

WLFI’s ownership concentration and heightened volatility — nearly eight times that of Bitcoin during the episode — may explain its rapid reaction to stress. While the findings are based on a single event, the data suggests structurally fragile, highly leveraged assets can act as early warning indicators in crypto markets.

Further analysis would be required to determine whether this pattern holds across future market shocks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.