XRP surged after Brad Garlinghouse joined the U.S. Commodity Futures Trading Commission Global Markets Advisory Committee, a development viewed as strengthening Ripple’s regulatory standing in Washington.

The committee, which includes executives from major crypto firms, focuses on digital asset policy, market structure and financial innovation. Garlinghouse’s appointment signals deeper engagement between industry leaders and U.S. regulators at a time when clearer oversight frameworks are being shaped.

For investors, the move represents a constructive shift following years of legal scrutiny surrounding Ripple’s operations. Markets reacted swiftly, pushing XRP higher before the token later retraced part of its gains.

On-Chain Data Shows Spike in XRP Ledger Activity

On-chain metrics reflect renewed interest. Active addresses on the XRP Ledger recently climbed above 30,000 in early February, indicating a surge in user activity and speculative participation. Although activity has since cooled to the 16,000 to 18,000 range, the earlier spike coincided with heightened price volatility.

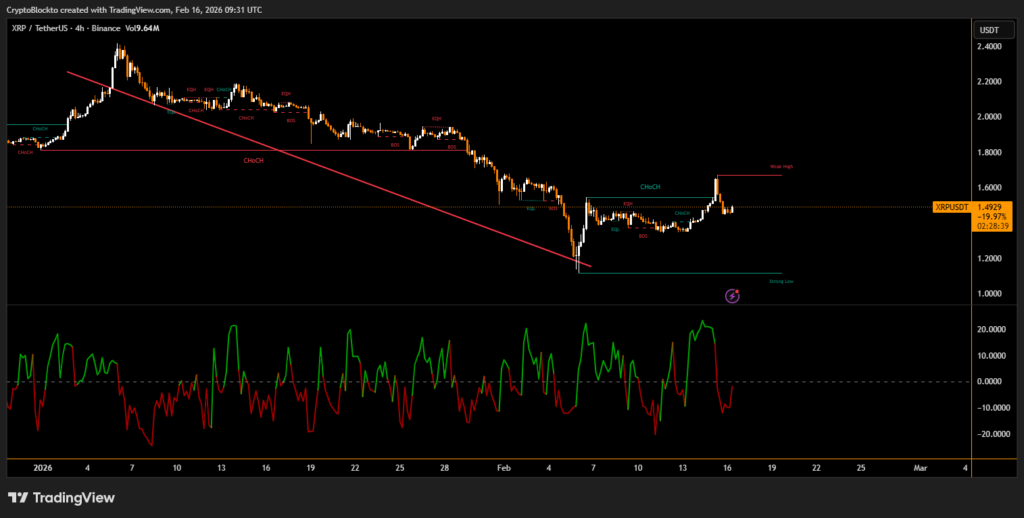

XRP Technical Analysis: Key Levels to Watch

At the time of writing, XRP trades near $1.49. Immediate resistance stands at $1.60, with a stronger barrier around $1.74. A decisive daily close above $1.74 could open the path toward $1.90–$2.00.

Support lies at $1.35, followed by the critical $1.20 level. While momentum indicators suggest selling pressure is easing, confirmation of a broader trend reversal requires a sustained breakout above key resistance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.