Bitcoin is hovering below the $70,000 mark as institutional outflows and heavy short positioning keep the market on edge. The world’s largest cryptocurrency recently traded near $68,600, extending a difficult start to the year. Quarter-to-date, Bitcoin is down more than 21%, marking its weakest first-quarter performance since 2015.

Bitcoin ETF Outflows Reflect Weak Institutional Demand

Spot BTC ETF recorded approximately $360 million in net outflows last week, while Ether products saw $161 million exit. Over the past month, digital asset investment products have shed roughly $3.7 billion, underscoring cautious institutional sentiment. Although selective capital rotation is visible, broader conviction remains limited as liquidity conditions stay tight.

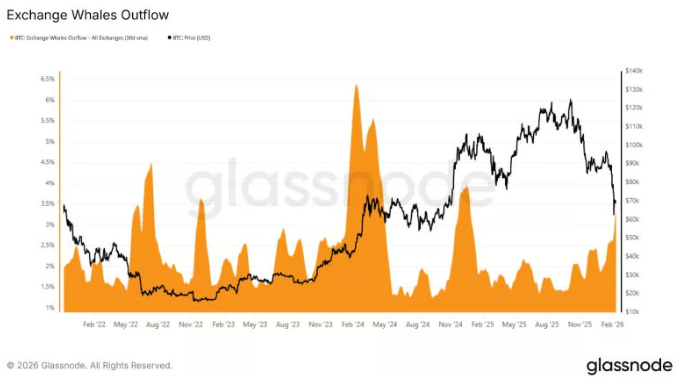

On-Chain Data Shows Whale Accumulation

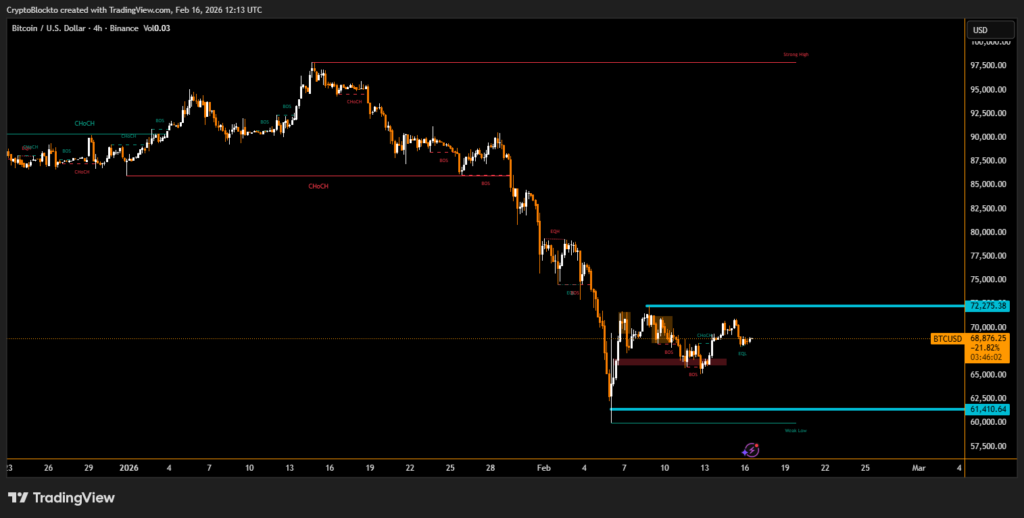

Despite price weakness, blockchain metrics present a more nuanced picture. Bitcoin’s market value to realized value ratio is hovering near 1.1, a level historically associated with undervaluation zones. Exchange data also indicates rising transfers to large holders, suggesting long-term investors may be quietly accumulating during consolidation between $60,000 and $72,000.

Derivatives Market Highlights Short Squeeze Risk

Futures positioning reveals crowded short exposure. A 10% upward move could trigger an estimated $4.3 billion in short liquidations, compared with roughly $2.4 billion in long liquidations on a similar decline. Elevated options volatility further signals that traders are preparing for a significant breakout.

With inflation cooling but macro uncertainty persisting, Bitcoin appears primed for a decisive and potentially sharp move in either direction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.