Ether is regaining attention from institutional investors as capital rotation and product innovation reshape sentiment. While ETH has struggled to reclaim the $2,500 level since late January and recently bottomed near $1,744, several structural developments suggest the broader trend may be turning.

Data shows roughly $327 million in net outflows from US listed Ether spot ETFs in February. However, that figure represents less than 3% of total assets under management, signaling that long-term positioning remains largely intact rather than signaling a broad institutional exit.

Recent regulatory filings revealed that Harvard’s endowment added an $87 million stake in iShares Ethereum Trust, managed by BlackRock. Notably, the allocation increase came alongside a reduction in its Bitcoin ETF exposure, suggesting selective conviction in Ethereum’s long-term thesis.

BlackRock Staking ETF and Fee Structure Attract Attention

BlackRock has also advanced its proposal for a staked Ether ETF, introducing an 18% retention on staking rewards to cover operational and service costs, including partnerships with custodians such as Coinbase. Despite debate over reward sharing, the 0.25% expense ratio positions the fund competitively within the ETF landscape.

Ethereum Dominates $20 Billion Real-World Asset Market

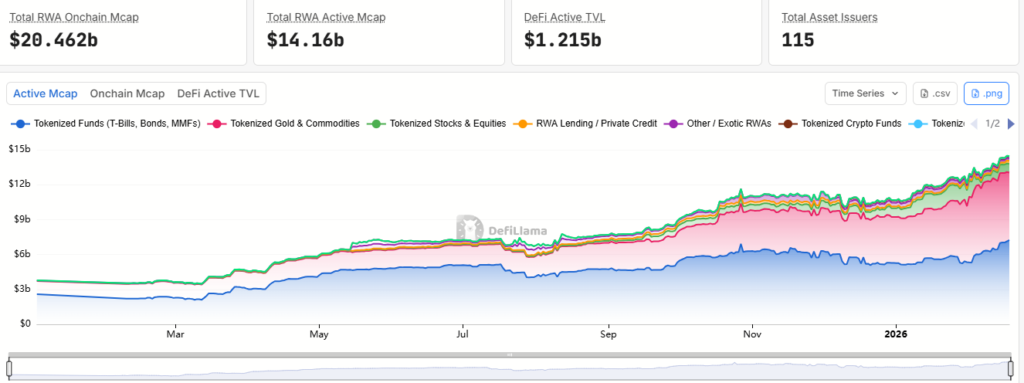

Ethereum’s leadership in tokenized real-world assets (RWAs) further strengthens the bullish case. The sector has surpassed $20 billion in onchain value, with Ethereum hosting major issuances from traditional finance heavyweights including JPMorgan Chase and Franklin Templeton.

Nearly half of Ethereum’s $13 billion RWA deposits consist of tokenized gold, while US Treasurys, bonds and money market instruments account for more than $5 billion. Compared to alternative networks, Ethereum’s dominance highlights institutional preference for security, infrastructure maturity and regulatory clarity over lower transaction costs.

If ETF adoption continues and RWA growth accelerates, Ether reclaiming $2,500 appears increasingly plausible in the near term.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.