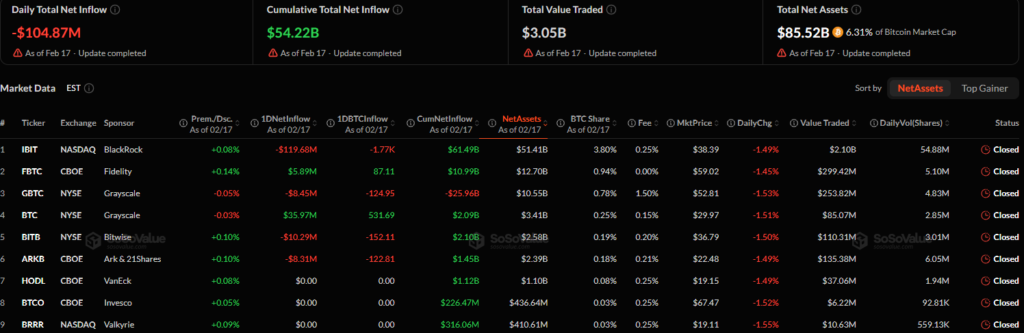

US spot Bitcoin exchange traded funds recorded $104.9 million in net outflows during Tuesday’s session, marking a subdued start to the trading week. Data shows that total volume across spot Bitcoin ETFs dropped to just over $3 billion, a steep decline from the $14.7 billion peak recorded earlier this month.

The slowdown reflects cooling short term momentum, even as institutional disclosures for the fourth quarter of 2025 reveal significant portfolio reshuffling among major investors.

Jane Street and Laurore Emerge as Major IBIT Buyers

Among the most notable buyers was Jane Street, which acquired approximately $276 million worth of shares in the iShares Bitcoin Trust during Q4.

Some analysts suggest the purchase could signal offshore institutional interest in regulated US Bitcoin exposure, though others question why such investors would choose an ETF vehicle instead of holding Bitcoin directly.

According to Bitwise Investments advisor Jeff Park;

More surprising was a single $436.2 million purchase by Laurore, a little-known Hong Kong based entity that disclosed its position through filings with the U.S. Securities and Exchange Commission. Public information about the firm remains limited, prompting speculation about the origin and motivation of the capital.

Institutional Rebalancing Accelerates

Other firms expanded their exposure. Mubadala Investment Company increased its IBIT holdings by 45%, bringing its stake to roughly $630 million. Weiss Asset Management and 59 North Capital also added sizable positions.

Conversely, Brevan Howard reduced its IBIT holdings by approximately 85%, while Goldman Sachs trimmed its position by about 40%.

The mixed activity highlights a market in transition, where long-term institutional positioning continues despite short-term ETF outflows.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.