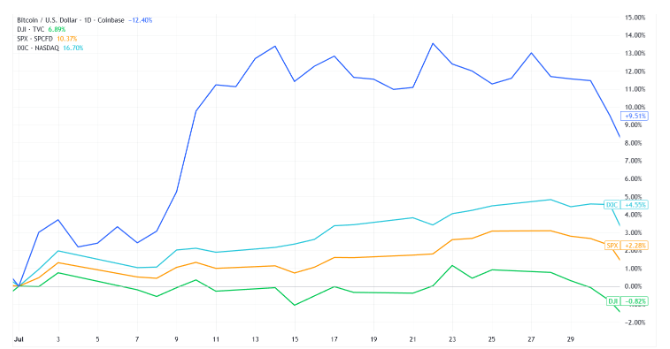

The recent divergence between Bitcoin and major U.S. technology stocks is drawing attention from macro investors who see it as an early warning of financial stress. While the Nasdaq 100 has struggled to maintain momentum, Bitcoin has shown relative strength, prompting debate about whether liquidity conditions are shifting beneath the surface of global markets.

Bitcoin has often traded in correlation with high growth tech equities, as both are considered liquidity-sensitive assets. When that relationship weakens, it can signal a change in credit expectations. Some market observers argue that Bitcoin reacts faster than equities to tightening or expansion in fiat liquidity, making it a barometer for stress in dollar-based credit systems.

AI Job Losses and Credit Market Risk

A key concern is the accelerating impact of artificial intelligence on employment. Reports indicate that tens of thousands of layoffs in 2025 have been linked to AI driven restructuring. If automation significantly reduces white-collar employment, household debt performance could deteriorate.

The United States has roughly 72 million knowledge workers. A hypothetical 20% displacement scenario could translate into hundreds of billions of dollars in consumer credit and mortgage exposure. Even a fraction of that turning delinquent would pressure regional banks, which remain sensitive after recent banking sector instability.

Federal Reserve Policy and Bitcoin Outlook

In a severe credit contraction, the Federal Reserve could be forced to reintroduce aggressive liquidity measures. Historically, expansions in central bank balance sheets have coincided with strong Bitcoin rallies. If monetary easing returns in response to financial strain, digital assets may once again benefit from renewed fiat liquidity.

Market participants are closely watching whether the current divergence is temporary—or the first sign of a broader credit cycle shift.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.