The United Arab Emirates has quietly emerged as a significant state linked bitcoin miner, with holdings now valued at approximately $453.6 million. On chain data from Arkham indicates that operations connected to Abu Dhabi’s royal network control around 6,782 BTC, representing roughly 0.03% of bitcoin’s total circulating supply. Based on current market prices, the position reflects about $344 million in unrealized profit, excluding energy and operational costs.

Mining output has remained steady, averaging 4.2 BTC per day over the past week. Large scale activity in the country accelerated in 2022, when Abu Dhabi based entities began expanding industrial mining infrastructure, including immersion-cooled facilities designed for high efficiency performance in Gulf climates.

Government Bitcoin Reserves and Mining Strategy

Unlike some sovereign holders that frequently move assets, the UAE has not recorded notable outflows from its identified wallets in four months. The strategy appears focused on long term retention rather than short term liquidation.

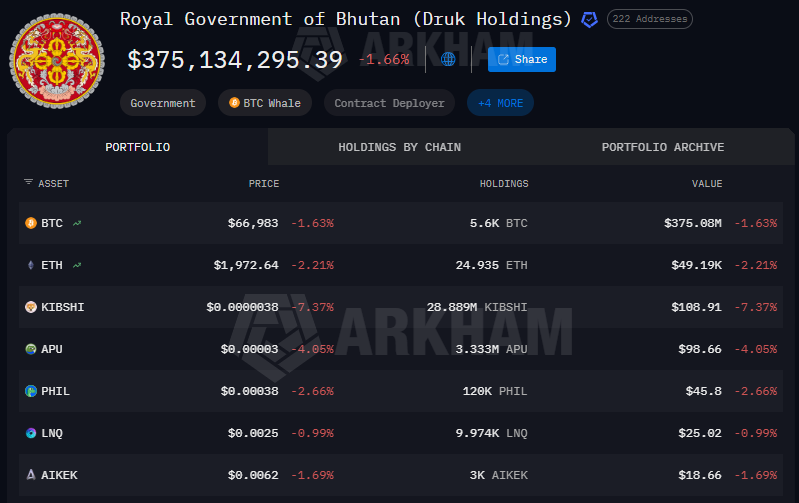

Other governments have taken different approaches. The Royal Government of Bhutan, through its investment arm, accumulated significant bitcoin reserves using hydroelectric power but has recently reduced its holdings. Meanwhile, the United States and the United Kingdom remain among the largest sovereign bitcoin holders, primarily through asset seizures linked to criminal investigations.

As institutional and government participation deepens, sovereign bitcoin reserves are becoming an increasingly visible component of global crypto markets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.