Recent weakness in Bitcoin is unlikely to be the result of quantum computing fears, according to veteran developer Matt Corallo, who dismissed the theory as inconsistent with broader market behavior.

Speaking on the Unchained podcast, Corallo said that if investors were genuinely concerned about near-term quantum threats to Bitcoin’s cryptography, other major networks such as Ether would likely be outperforming sharply. Instead, Ether has also experienced significant declines in recent months, undermining the argument that capital is rotating away from Bitcoin due to quantum risk.

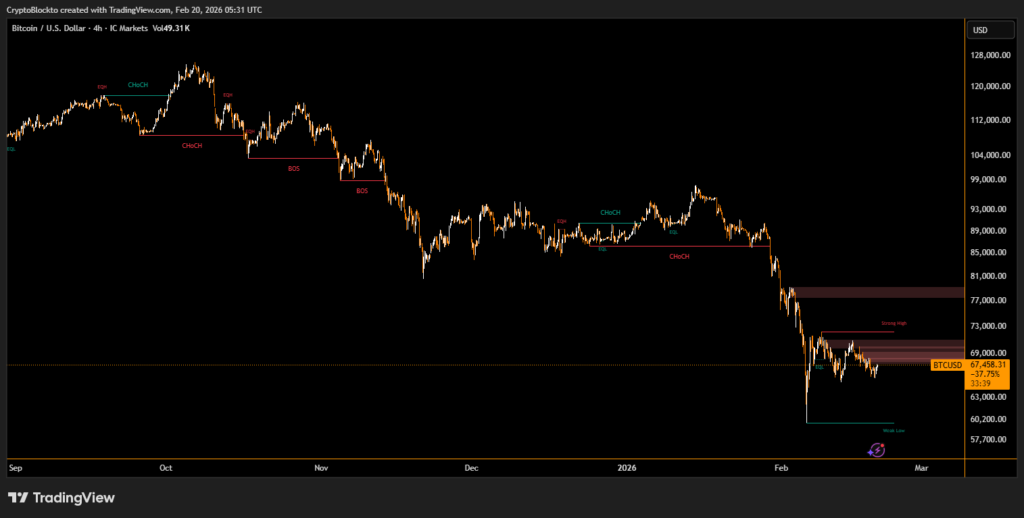

Bitcoin has fallen roughly 46% from its October all time high near $126,000 to trade around the mid-$67,000 range. Some market participants have attributed the drop in part to concerns that future quantum computers could compromise existing encryption standards. However, Corallo said market makers do not appear to treat quantum breakthroughs as an imminent threat.

Capital Competition From AI Seen as Larger Factor

Corallo suggested a more plausible explanation is intensifying competition for investment capital, particularly from artificial intelligence ventures. He argued that AI represents a capital-intensive and rapidly expanding sector attracting institutional and retail funds that might otherwise flow into digital assets.

Not all industry voices agree. Some investors maintain that quantum risks should already be factored into Bitcoin’s valuation until mitigation strategies are fully implemented.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.