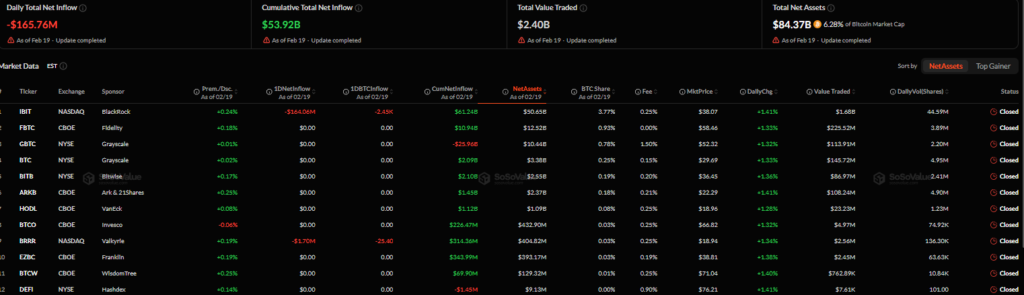

U.S.-listed spot Bitcoin exchange traded funds continued to see capital exit the market, shedding $165.8 million in net outflows on Thursday. The latest redemptions pushed total weekly losses to $403.9 million and brought year to date outflows to approximately $2.7 billion, raising the prospect of a fifth consecutive week of net withdrawals.

Trading activity has also cooled. Weekly ETF volume declined by 21%, marking the lowest level since late December and reflecting fading investor participation. Despite cumulative net inflows of $53.9 billion since launch, the recent shift underscores weakening demand for Bitcoin exposure through regulated investment vehicles.

BlackRock IBIT Leads Outflows

The largest share of this week’s redemptions came from BlackRock’s iShares Bitcoin Trust (IBIT), which recorded $368 million in outflows. The Fidelity Wise Origin Bitcoin Fund also posted roughly $50 million in withdrawals, while other issuers saw limited activity.

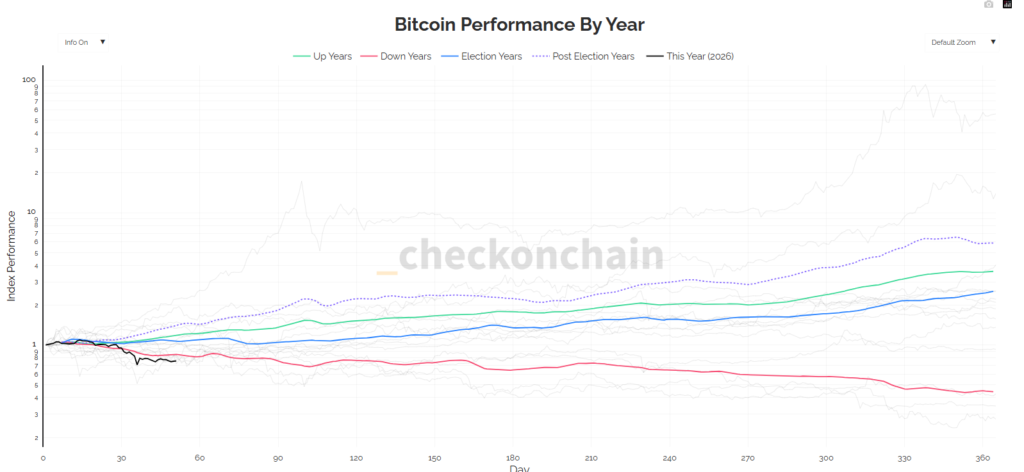

Bitcoin Price Performance Signals Weak Start to 2026

Bitcoin prices are down roughly 22% year to date, hovering near $67,000 and close to levels seen around the April 2024 halving. Historical data suggests that previous post-halving periods typically delivered significantly stronger performance by this stage.

Market analysts note that, 50 days into 2026, Bitcoin is tracking its weakest start on record, surpassing declines seen in prior down cycles such as 2018.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.