Democrats on the House Financial Services Committee are seeking answers from Treasury Secretary Scott Bessent regarding regulators’ review of World Liberty Financial’s application for a national trust bank charter.

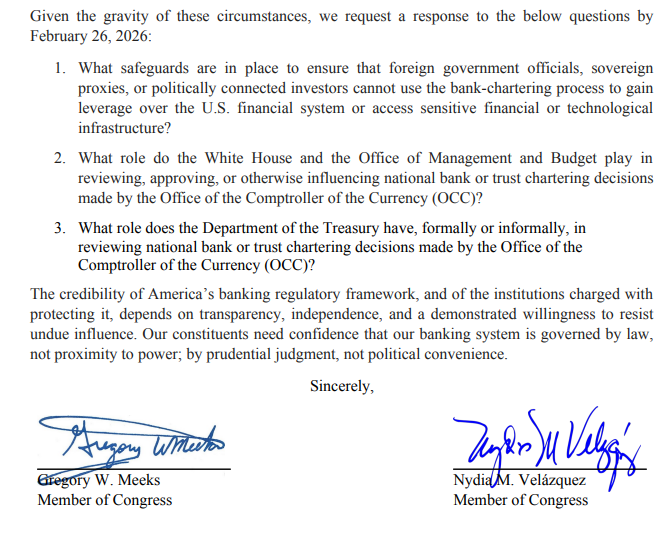

In a letter led by Representative Gregory Meeks, 41 House Democrats cited concerns about systemic risk, foreign ownership and potential political influence over the chartering process. The company is reportedly pursuing approval from the Office of the Comptroller of the Currency to operate as a national trust bank and issue a dollar-backed digital token.

Lawmakers pointed to reports that a senior royal from the United Arab Emirates acquired nearly half of World Liberty Financial in a deal valued at roughly $500 million. They questioned whether foreign political interests could gain leverage within the U.S. financial system through the charter process.

Oversight and Political Influence Under Scrutiny

The letter also referenced Executive Order 14215, raising concerns that increased White House oversight of financial regulators could compromise the OCC’s independence in reviewing the application.

Separately, Senator Elizabeth Warren urged Treasury and Federal Reserve officials not to extend taxpayer backed support to crypto firms, warning against moral hazard.

The inquiries come as World Liberty Financial and other politically connected crypto initiatives expand their presence in Washington, intensifying debate over regulatory safeguards and the evolving role of digital assets in the U.S. banking system.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.