Digital asset markets have shed nearly $1 trillion in market capitalization over the past month, as Bitcoin and major altcoins remain under sustained pressure. Despite the sharp correction in spot prices, capital formation within blockchain infrastructure and tokenized real world assets continues to advance.

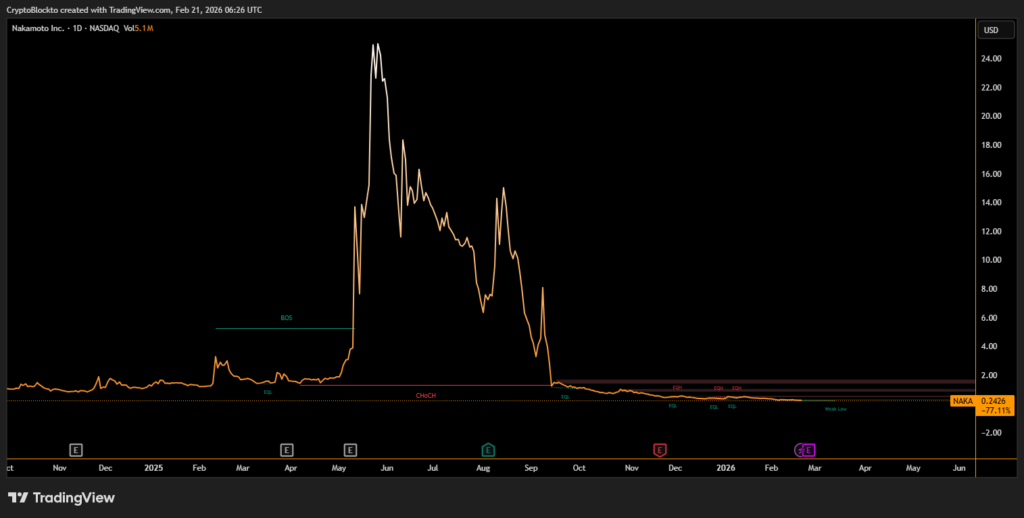

One notable development is a $107 million acquisition plan by Nakamoto, which will bring BTC Inc and UTXO Management under its corporate structure. The deal expands its exposure to Bitcoin focused media, events and asset management services, consolidating operations during a period of market stress.

Venture Capital Shifts Toward Blockchain Infrastructure

Institutional appetite for blockchain based financial infrastructure remains active. Dragonfly Capital recently closed a $650 million fund aimed at payment systems, stablecoin networks, lending platforms and tokenized asset markets. The move reflects a broader pivot away from speculative token launches toward revenue-generating onchain financial products.

Tokenized Real-World Assets Gain Traction

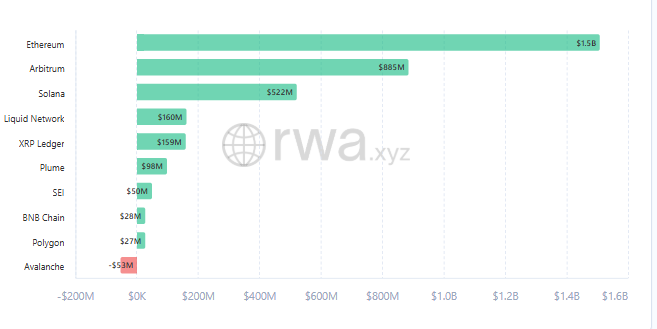

The tokenized RWA sector has expanded approximately 13.5% over the past 30 days, driven largely by tokenized US Treasurys and private credit instruments. Growth has been particularly visible on Ethereum, alongside Arbitrum and Solana networks.

Separately, Paradigm reiterated that Bitcoin mining could help stabilize power grids by adjusting energy consumption during peak and off-peak periods. As AI-driven electricity demand rises, flexible mining operations may play a growing role in energy market dynamics.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.