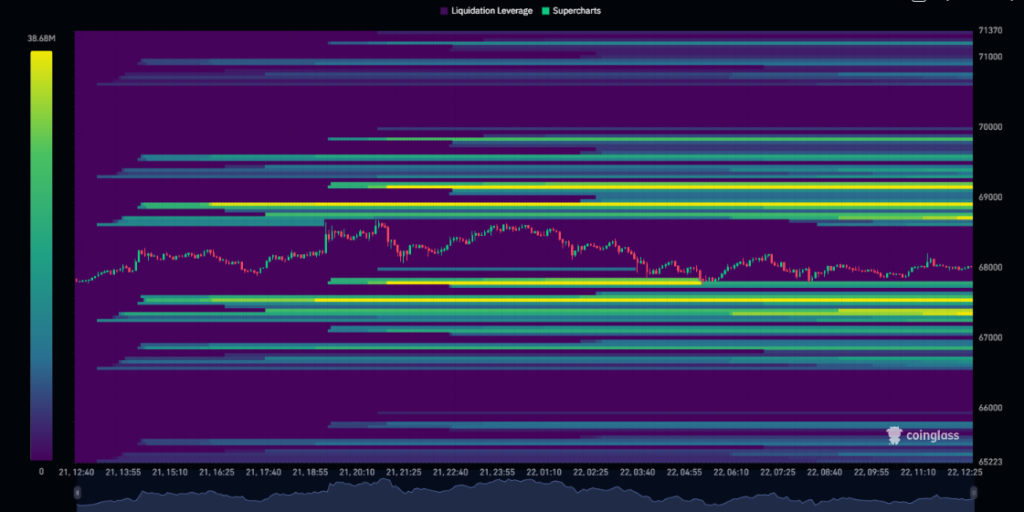

New derivatives data indicates that Bitcoin could trigger significant liquidation cascades if it moves beyond key price thresholds in the near term.

According to figures compiled by Coinglass, a breakout above $70,000 would expose approximately $7.91 billion in cumulative short liquidation intensity across major centralized exchanges (CEXs). This suggests that a strong upward move could force bearish traders to close leveraged positions, accelerating volatility through a short squeeze.

Long Liquidation Risk Builds Below $66,000

On the downside, a decline below $66,000 would put roughly $7.78 billion in cumulative long liquidation intensity at risk. In this scenario, leveraged bullish positions could be forcibly closed, adding further downward pressure to the market.

It is important to note that liquidation heatmaps do not represent the precise dollar value of contracts set to be liquidated. Instead, they illustrate relative intensity highlighting where concentrated leverage may amplify price movements.

Liquidation Clusters and Market Volatility

Taller bars on liquidation charts indicate stronger potential reactions as price reaches those levels. When large clusters are triggered, cascading orders can magnify volatility within a short timeframe.

With Bitcoin trading near critical resistance and support zones, derivatives positioning suggests the market remains highly sensitive to breakout or breakdown scenarios in the coming sessions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.