Wall Street recorded $8.3 billion in stock sales over the past week, marking the second-largest weekly outflow since the 2008 financial crisis. The sharp reduction in equity exposure highlights rising institutional caution amid renewed economic and geopolitical pressures.

Concerns intensified following renewed tariff discussions, including proposals for a 10% import levy, alongside persistent geopolitical tensions involving China and Iran. Weaker than expected quarterly earnings in technology and industrial sectors further fueled volatility across the S&P 500 and Nasdaq Composite, both of which saw increased price swings during the week.

Capital Rotation Into Gold, Bonds and Bitcoin

As equities declined, investors redirected capital toward perceived defensive assets. Gold prices strengthened amid safe-haven demand, while bond markets also attracted inflows.

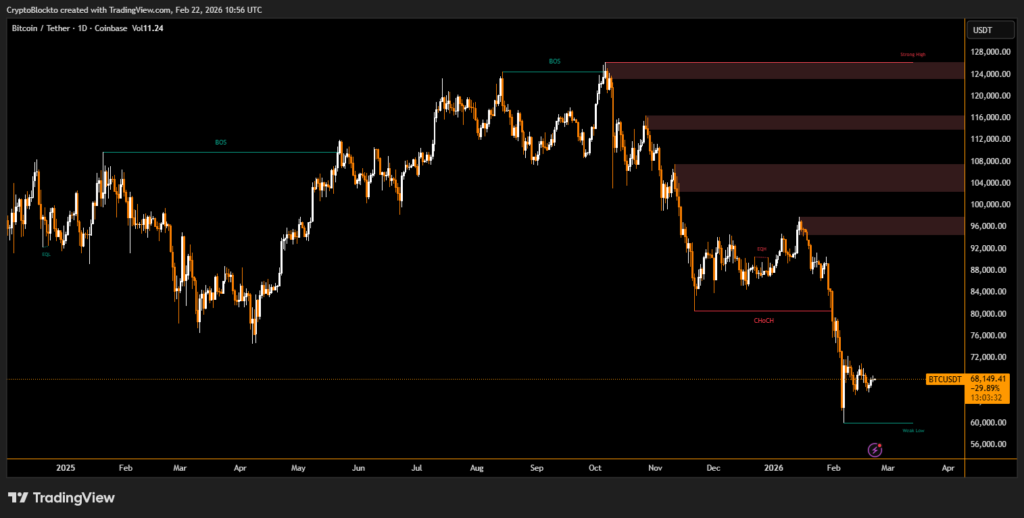

At the same time, Bitcoin traded near $68k, drawing renewed attention as an alternative asset. Market data showed a rise in crypto trading volumes and continued accumulation by large holders, commonly referred to as whales. Analysts note that Bitcoin’s capped supply and decentralized structure contribute to its appeal during periods of monetary and political uncertainty.

Portfolio Diversification Trends Accelerate

The latest equity outflows have sparked broader discussions around portfolio diversification. Some investors are increasing crypto allocations within balanced strategies, typically ranging between 10% and 20%, as a hedge against systemic financial risks.

While volatility remains elevated across digital assets, the shift suggests that Bitcoin and broader crypto markets are increasingly viewed as part of the global capital rotation during periods of traditional market stress.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.